How Amazon FBA audit tools uncover hidden fee losses in 2026

Jan 1, 2026

Jan 1, 2026

Jan 1, 2026

TL;DR

Hidden fee losses in Amazon FBA are common and often go unnoticed because fees are charged quietly and spread across multiple reports.

In 2026, more granular FBA and referral fee changes, automation, and higher SKU volume increase the risk of silent overcharges.

Small per-unit errors in fulfillment, storage, placement, or dimensional weight fees compound into significant margin loss at scale.

Amazon FBA audit tools reconcile disconnected Seller Central data to identify incorrect fees that never trigger alerts or refunds.

Combining automated audits with human validation improves accuracy and recovery rates under current reimbursement policies.

Regular fee audits recover confirmed profit without increasing ad spend, traffic, or pricing risk.

Selling on Amazon? Don’t let this hidden leak eat your profits.

Tiny fee errors, mis-scans, and incorrect charges that never trigger an alert, never show up as a red flag, and never get questioned. Because these costs sit behind the scenes, sellers naturally focus on what feels controllable: ads, PPC, storage, and pricing. Meanwhile, the real leak keeps running in the background. That is the invisible fee problem Amazon sellers miss.

In 2026, this problem will become harder to ignore. Amazon’s fees are more automated, more granular, and recalculated at scale. A few cents added to fulfillment or dimensional fees no longer feel small when multiplied across thousands of orders and multiple SKUs.

This is why an Amazon FBA audit tool for hidden fee recovery is no longer a “nice to have.” It acts as a visibility layer, connecting data that Seller Central keeps separate and showing sellers where money is slipping away. The Amazon FBA reconciliation tool helps sellers see the fees they are paying before those fees quietly become permanent margin loss.

What “hidden fee losses” actually mean in Amazon FBA

When sellers hear “hidden fee losses,” they often assume it means rare edge cases. In reality, these are everyday Amazon FBA fee discrepancies that never trigger alerts, emails, or warnings inside Seller Central. Amazon charges the fees quietly, and most sellers only notice when margins feel tighter month after month.

These losses usually come from fees that look normal in isolation but are wrong in context. Seller Central reports are fragmented; weight data sits in one place, fee previews in another, and reimbursements in a third. There is no single report that clearly says, “This charge was incorrect.” That is why Amazon FBA incorrect fee charges are so hard to catch manually.

The real problem is scale. A small Amazon dimensional weight error, say $0.30 extra per unit due to a wrong scan, feels harmless. But if you sell 2,000 units a month, that turns into $600 quietly gone. Multiply this across multiple ASINs and months, and the loss becomes significant without ever looking dramatic.

For example, a seller ships a standard-size product that weighs 450 g. After a mis-scan, Amazon bills it as oversized. Fulfillment fees jump by 20–50% per unit. The product still sells well, so no red flags appear. The seller only sees declining profit.

The same happens with Amazon storage fee overcharges, missing units that never get reimbursed, or processing penalties applied automatically. Without a dedicated audit, these issues stay invisible, yet they directly eat into your FBA profit in 2026.

Why are hidden fee losses increasing in 2026?

Hidden fee losses are not new on Amazon, but in 2026, they are happening more often and on a larger scale. The main reason is complexity. Amazon has announced changes to FBA and referral fees for 2026, which will take effect on January 15, 2026.

Amazon’s fee structure has expanded significantly over the last few years. Fulfillment fees, placement fees, storage charges, dimensional weight calculations, and category-based referral fees now interact in ways that are difficult to track manually.

At the same time, seller operations are moving faster. Brands are launching more SKUs, shipping inventory more frequently, and distributing stock across multiple fulfillment centers. With higher volume, even small fee mismatches become harder to notice. A few cents extra per unit does not raise alarms, but across thousands of orders, it quietly turns into a meaningful loss.

Another factor is automation on Amazon’s side. Fee calculations are increasingly system-driven, with fewer human checks. When errors happen, they often do not trigger notifications. Seller Central reports still show totals, but not always the “why” behind discrepancies, making fee issues easy to miss unless someone is actively looking.

Finally, internal seller teams are stretched thin. Ads, inventory planning, and compliance take priority, while backend fee accuracy is reviewed infrequently. As a result, errors go unchallenged until reimbursement claim windows close.

Fee type | What changed in 2026 | Why does it create hidden losses |

Fulfillment fees | More granular fee slabs based on size, weight, and handling | Small miscalculations per unit go unnoticed at scale |

Placement fees | Increased use of regional and split placement charges | Sellers struggle to reconcile fees across multiple FCs |

Storage charges | Higher seasonal rates and stricter age-based fees | Long-term storage costs rise without clear alerts |

Dimensional weight | Greater reliance on automated size measurements | Minor dimension errors push products into higher fee tiers |

Category referral fees | More sub-category level fee structures | Misclassification leads to ongoing overcharges |

How do Amazon FBA audit tools detect fee losses?

Most Amazon sellers know fees exist, but very few can clearly see where fees go wrong. That is where Amazon FBA audit tools make a difference. They step in where manual tracking falls apart and bring clarity to fees that are otherwise easy to miss.

Instead of relying on surface-level Seller Central reports, these tools work in the background, cross-checking data that Amazon does not connect to you. The goal is simple: identify fee losses that look normal individually but are incorrect when validated end-to-end.

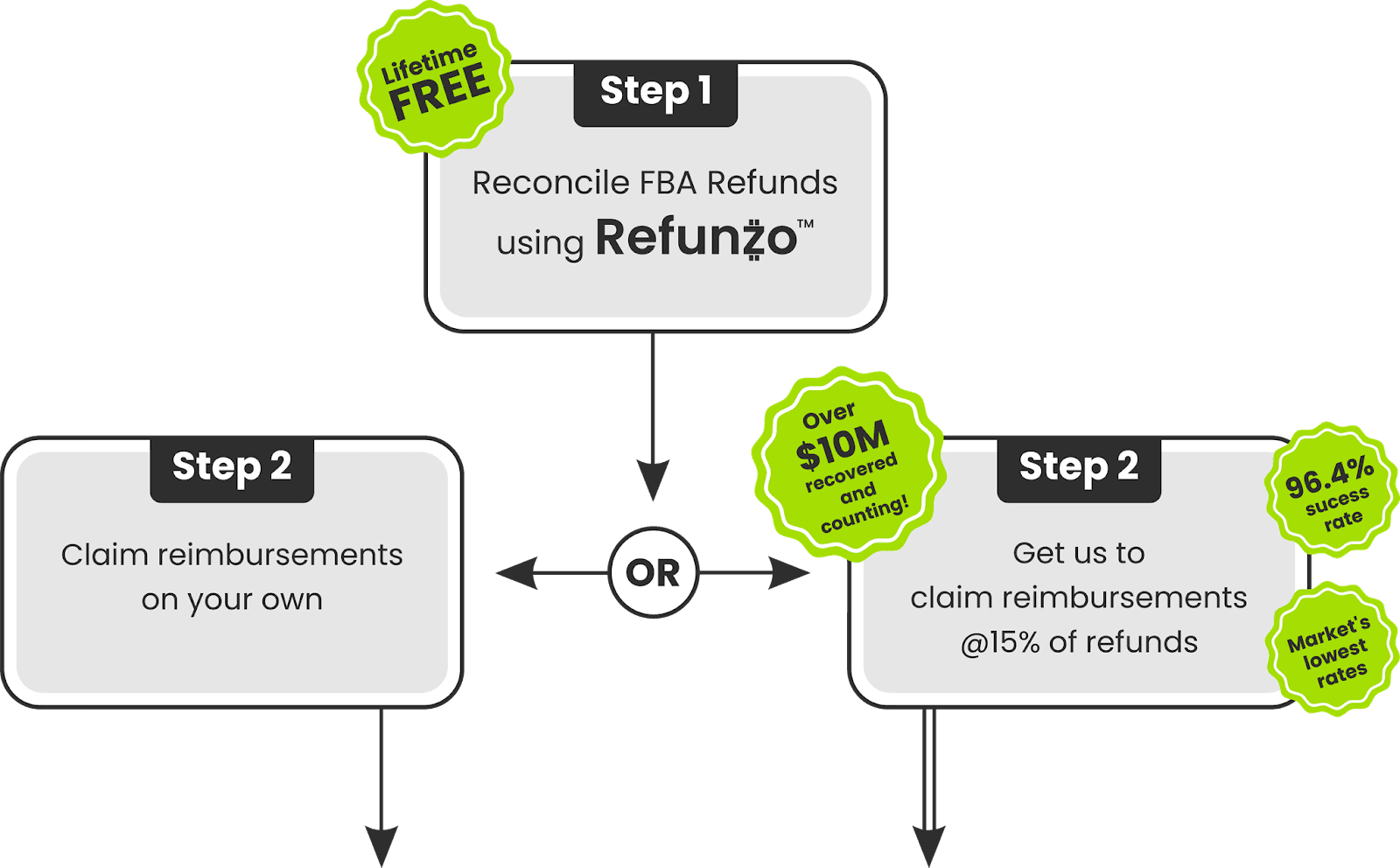

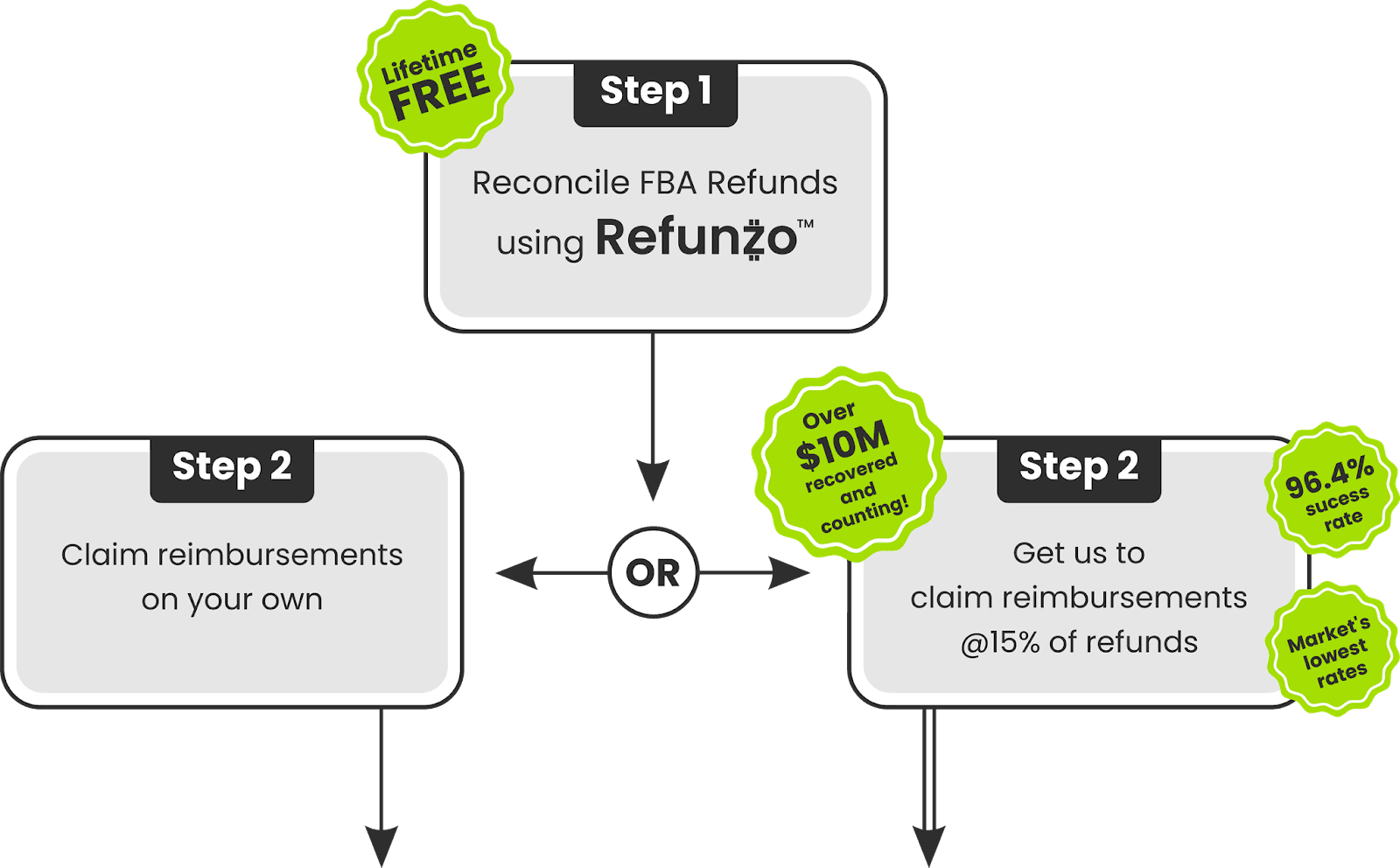

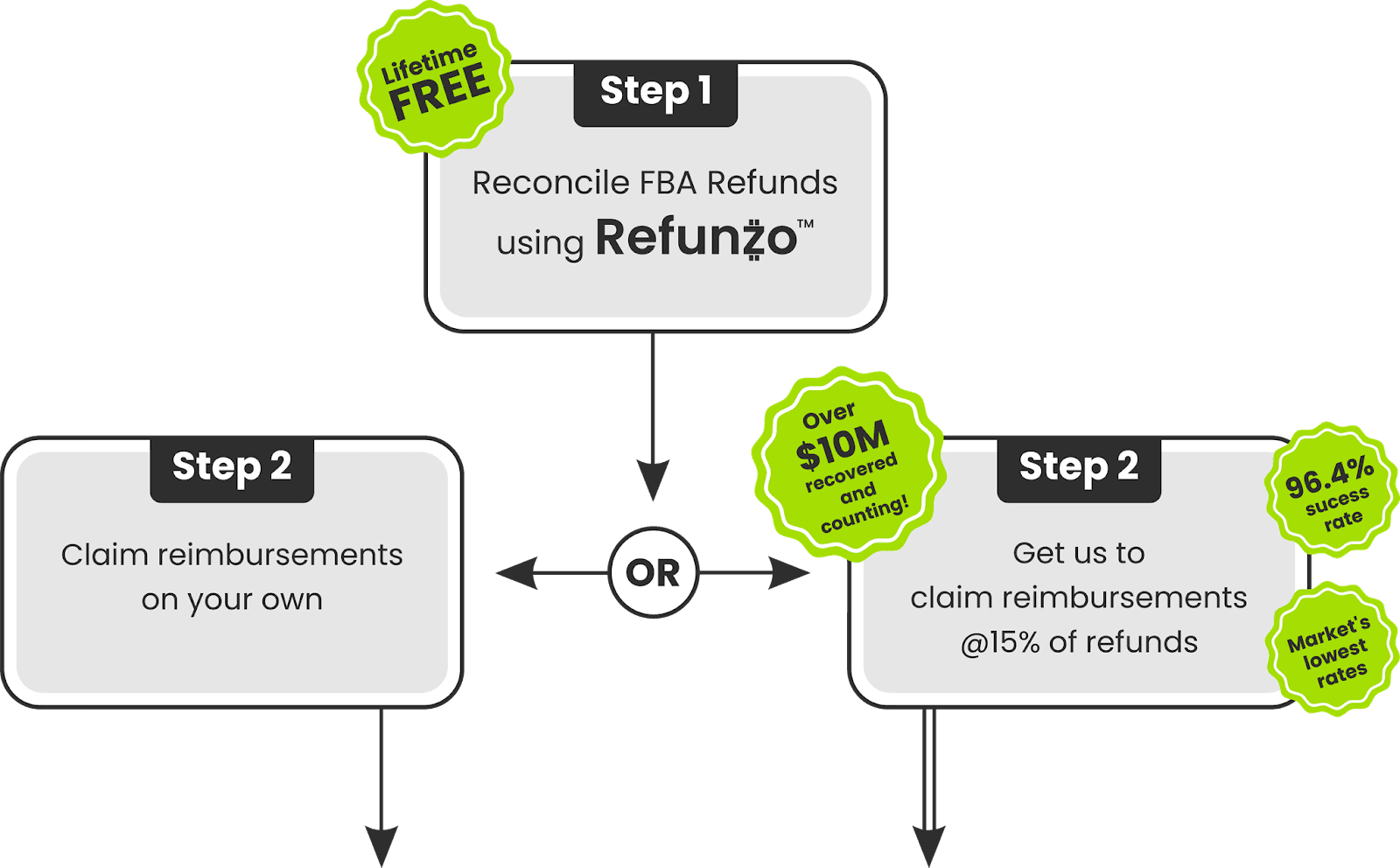

With Amazon FBA reconciliation tools like Refunzo, the process starts with reconciliation, not Amazon reimbursement claims. You connect your Seller Central account and run a comprehensive audit across more than 20 checkpoints. These checks cover inventory movements, fulfillment fees, storage fees, removals, returns, and processing charges.

This matters because many sellers only look at reimbursements, while real losses often sit in fee calculations that never trigger a refund alert.

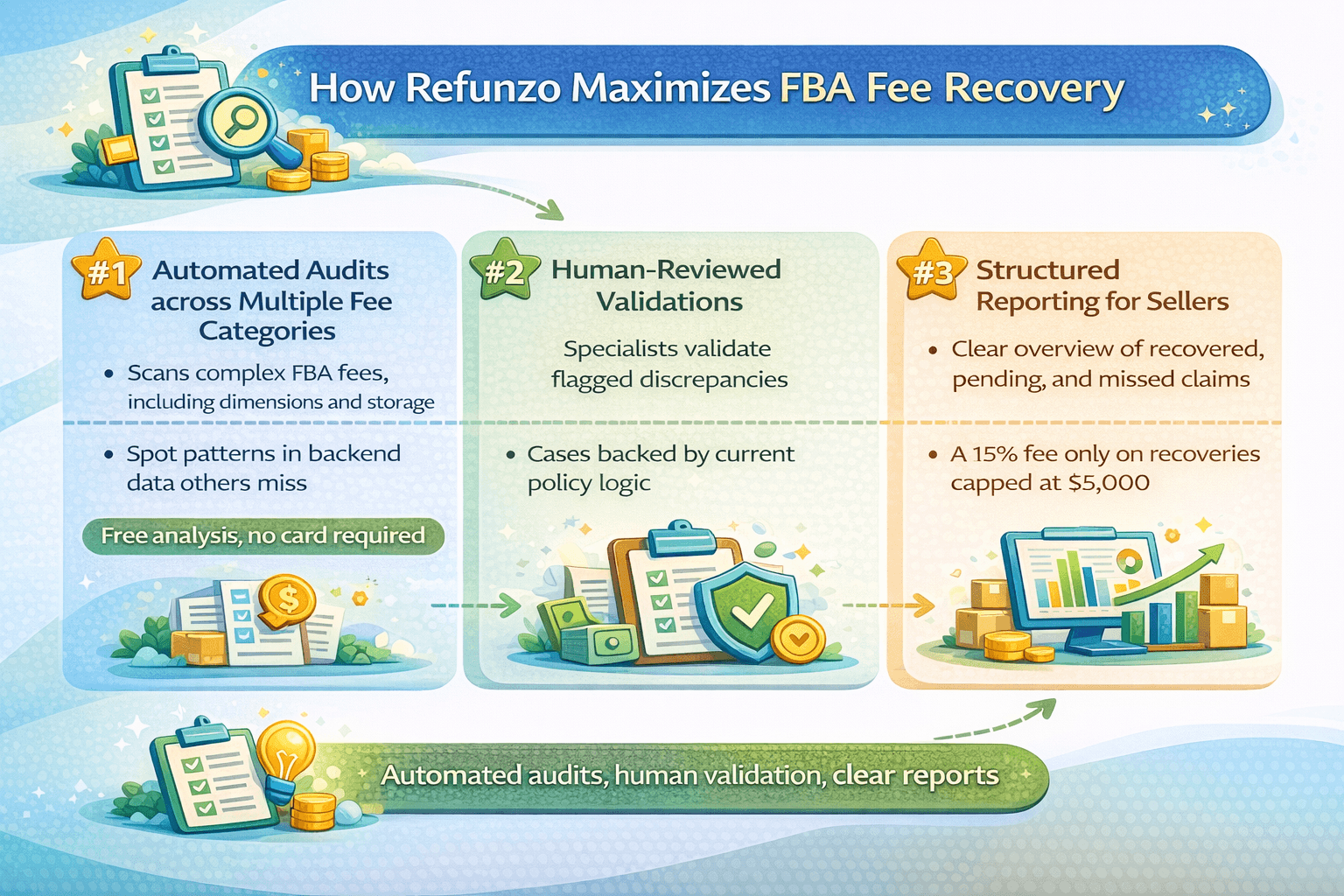

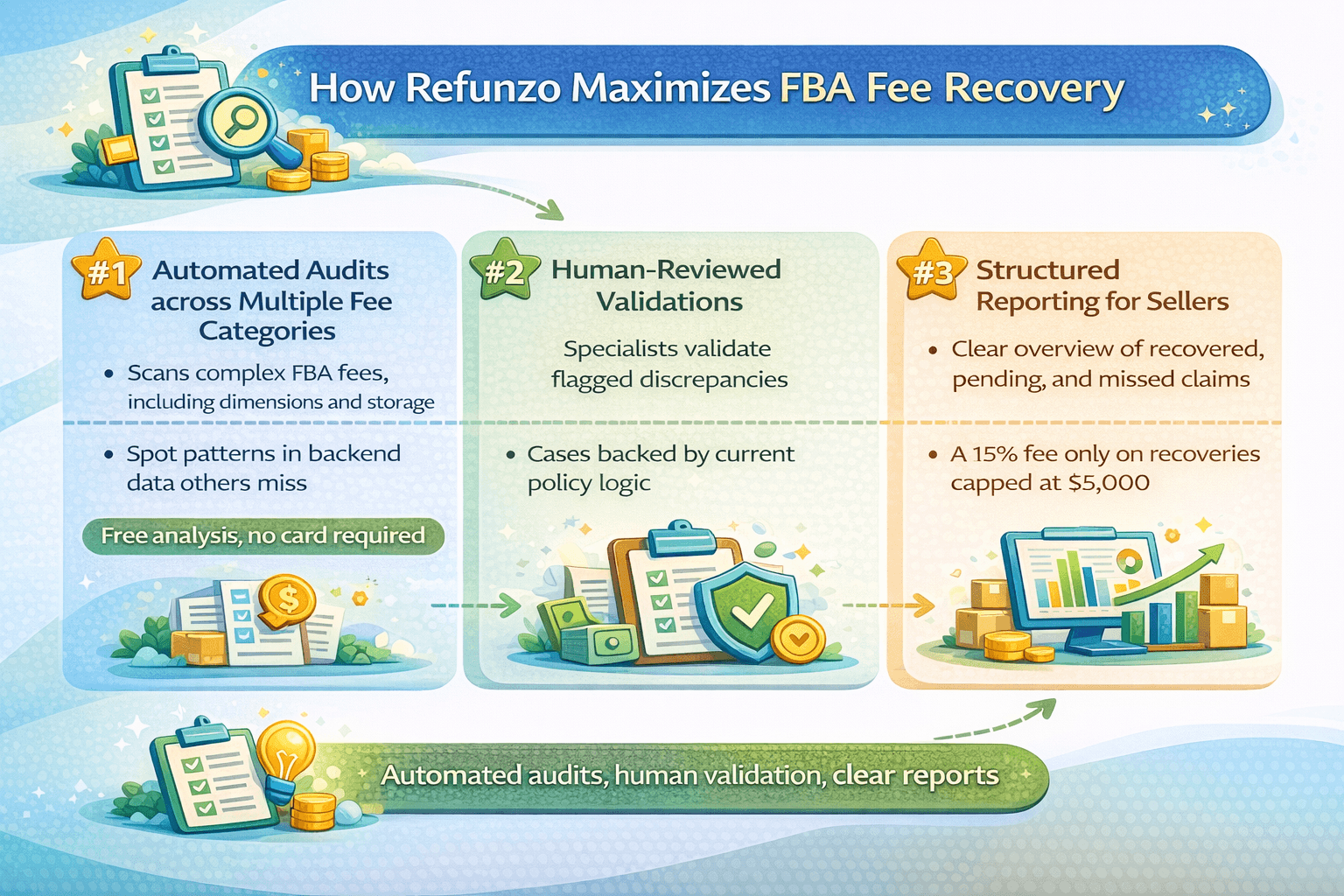

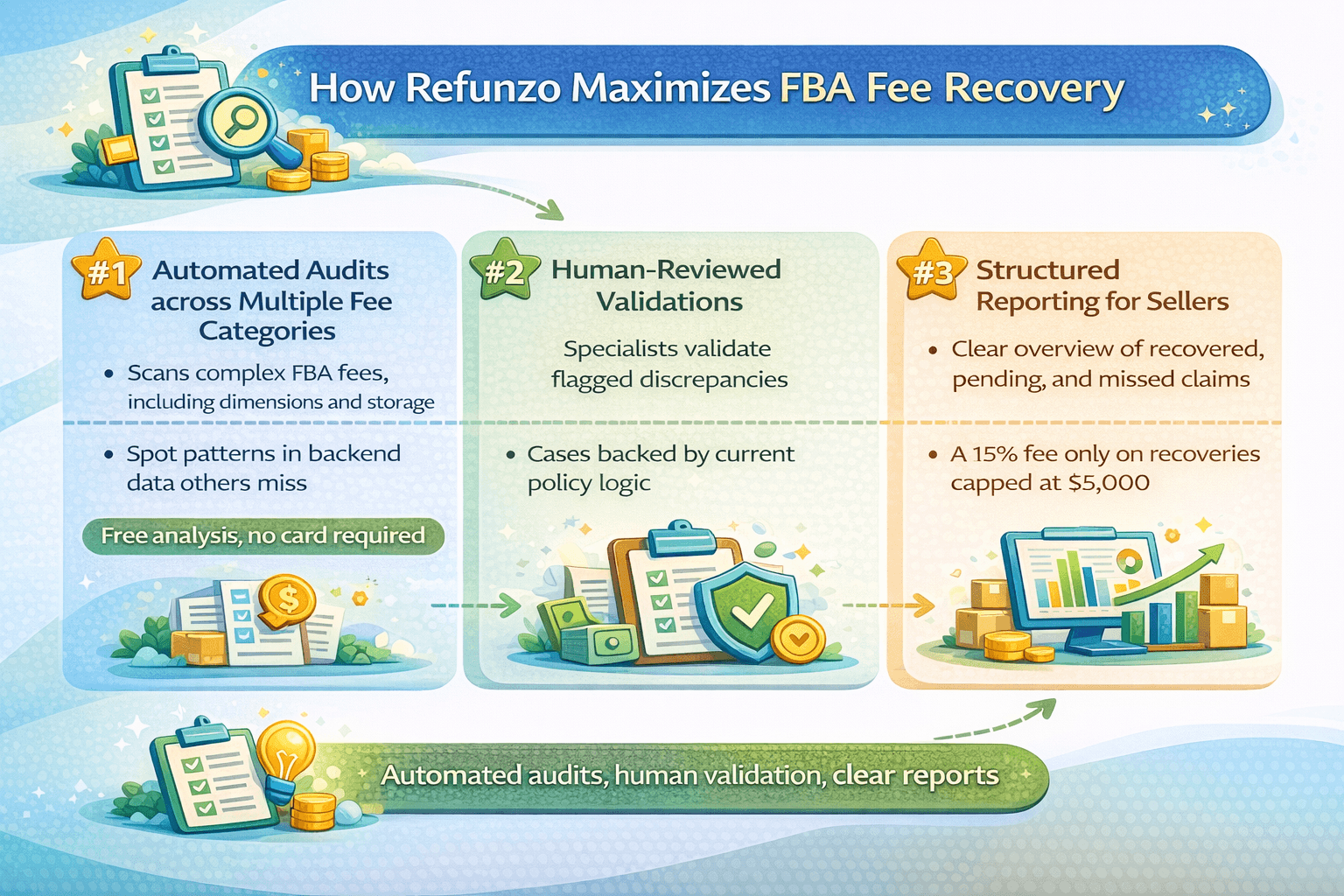

#1 Automated audits across multiple fee categories

Refunzo scans your account across multiple fee types at once, not just lost or damaged inventory. It reviews backend data tied to Amazon FBA fee discrepancies, dimensional weight mismatches, storage fee calculations, and processing errors.

Because the audit runs at scale, it can spot patterns that manual reviews miss, like a recurring overcharge across multiple shipments or a single SKU repeatedly billed at the wrong size tier. Within minutes, sellers receive a detailed reconciliation report showing where Amazon may owe money, along with an estimated refund value. This first step is free for life, no card required, which lets sellers check inventory accuracy without risk.

#2 Human-reviewed validations

Automation finds issues fast, but accuracy still matters. Every potential discrepancy flagged by Refunzo is reviewed by an Amazon reimbursement specialist before a case is prepared. This step ensures claims align with Amazon’s latest reimbursement policies and reduces rejections.

Each case is handled individually, supported with the right data and documentation. This protects sellers from aggressive or incorrect claims while improving approval rates. It also means sellers are not guessing whether a charge is valid or not; the claim is backed by policy logic.

#3 Structured reporting for sellers

Clarity is where most sellers struggle. Refunzo solves this with clean, structured reporting. Sellers can clearly see recovered amounts, pending cases, and missed opportunities in one place. There is no digging across reports or spreadsheets.

Sellers can choose to file claims themselves using Refunzo’s data or let the team handle everything. If managed, the fee is 15% of recovered reimbursements, capped at $5,000. No recovery means no fee.

By combining automated audits, human validation, and transparent reporting, Refunzo turns fee recovery into a controlled, trustworthy process. For sellers scaling in 2026, this approach makes hidden fee losses visible, understandable, and recoverable.

Why does this affect your profits on Amazon?

Amazon applies fulfillment, storage, placement, and processing fees automatically; even tiny miscalculations affect every order.

Most sellers only check fees when profit feels “off,” by then months of loss are already baked in.

A $0.10–$0.20 fee error per unit looks harmless, but at scale, it outperforms bad ad spend in damage.

Fee-related margin compression usually shows up before performance metrics move.

FNSKU-level fees, dynamic storage rules, and automated decisions make spot checks unreliable.

Fee recovery returns confirmed money, no traffic, no bids, no algorithm risk.

Sellers who skip audits are not saving effort; they are accepting silent profit erosion.

Final words

Hidden fee losses are not a rare edge case anymore; they are part of how Amazon operates at scale in 2026. If fees are not actively checked, they are quietly accepted. Once the Amazon reimbursement claim windows close, that money is gone for good.

The good news is that it is one of the few margin problems sellers can actually control. You do not need more traffic, higher bids, or risky pricing changes. You need visibility. When fees are audited consistently, errors stop being invisible and start becoming recoverable cash.

That is where Amazon reimbursement software like Refunzo comes into play. It helps you see what Seller Central does not surface, verify what is correct, and recover what is not. If your margins feel tighter but sales look fine, do not guess. Run a reconciliation, see what is being missed, and decide with real numbers, not assumptions.

TL;DR

Hidden fee losses in Amazon FBA are common and often go unnoticed because fees are charged quietly and spread across multiple reports.

In 2026, more granular FBA and referral fee changes, automation, and higher SKU volume increase the risk of silent overcharges.

Small per-unit errors in fulfillment, storage, placement, or dimensional weight fees compound into significant margin loss at scale.

Amazon FBA audit tools reconcile disconnected Seller Central data to identify incorrect fees that never trigger alerts or refunds.

Combining automated audits with human validation improves accuracy and recovery rates under current reimbursement policies.

Regular fee audits recover confirmed profit without increasing ad spend, traffic, or pricing risk.

Selling on Amazon? Don’t let this hidden leak eat your profits.

Tiny fee errors, mis-scans, and incorrect charges that never trigger an alert, never show up as a red flag, and never get questioned. Because these costs sit behind the scenes, sellers naturally focus on what feels controllable: ads, PPC, storage, and pricing. Meanwhile, the real leak keeps running in the background. That is the invisible fee problem Amazon sellers miss.

In 2026, this problem will become harder to ignore. Amazon’s fees are more automated, more granular, and recalculated at scale. A few cents added to fulfillment or dimensional fees no longer feel small when multiplied across thousands of orders and multiple SKUs.

This is why an Amazon FBA audit tool for hidden fee recovery is no longer a “nice to have.” It acts as a visibility layer, connecting data that Seller Central keeps separate and showing sellers where money is slipping away. The Amazon FBA reconciliation tool helps sellers see the fees they are paying before those fees quietly become permanent margin loss.

What “hidden fee losses” actually mean in Amazon FBA

When sellers hear “hidden fee losses,” they often assume it means rare edge cases. In reality, these are everyday Amazon FBA fee discrepancies that never trigger alerts, emails, or warnings inside Seller Central. Amazon charges the fees quietly, and most sellers only notice when margins feel tighter month after month.

These losses usually come from fees that look normal in isolation but are wrong in context. Seller Central reports are fragmented; weight data sits in one place, fee previews in another, and reimbursements in a third. There is no single report that clearly says, “This charge was incorrect.” That is why Amazon FBA incorrect fee charges are so hard to catch manually.

The real problem is scale. A small Amazon dimensional weight error, say $0.30 extra per unit due to a wrong scan, feels harmless. But if you sell 2,000 units a month, that turns into $600 quietly gone. Multiply this across multiple ASINs and months, and the loss becomes significant without ever looking dramatic.

For example, a seller ships a standard-size product that weighs 450 g. After a mis-scan, Amazon bills it as oversized. Fulfillment fees jump by 20–50% per unit. The product still sells well, so no red flags appear. The seller only sees declining profit.

The same happens with Amazon storage fee overcharges, missing units that never get reimbursed, or processing penalties applied automatically. Without a dedicated audit, these issues stay invisible, yet they directly eat into your FBA profit in 2026.

Why are hidden fee losses increasing in 2026?

Hidden fee losses are not new on Amazon, but in 2026, they are happening more often and on a larger scale. The main reason is complexity. Amazon has announced changes to FBA and referral fees for 2026, which will take effect on January 15, 2026.

Amazon’s fee structure has expanded significantly over the last few years. Fulfillment fees, placement fees, storage charges, dimensional weight calculations, and category-based referral fees now interact in ways that are difficult to track manually.

At the same time, seller operations are moving faster. Brands are launching more SKUs, shipping inventory more frequently, and distributing stock across multiple fulfillment centers. With higher volume, even small fee mismatches become harder to notice. A few cents extra per unit does not raise alarms, but across thousands of orders, it quietly turns into a meaningful loss.

Another factor is automation on Amazon’s side. Fee calculations are increasingly system-driven, with fewer human checks. When errors happen, they often do not trigger notifications. Seller Central reports still show totals, but not always the “why” behind discrepancies, making fee issues easy to miss unless someone is actively looking.

Finally, internal seller teams are stretched thin. Ads, inventory planning, and compliance take priority, while backend fee accuracy is reviewed infrequently. As a result, errors go unchallenged until reimbursement claim windows close.

Fee type | What changed in 2026 | Why does it create hidden losses |

Fulfillment fees | More granular fee slabs based on size, weight, and handling | Small miscalculations per unit go unnoticed at scale |

Placement fees | Increased use of regional and split placement charges | Sellers struggle to reconcile fees across multiple FCs |

Storage charges | Higher seasonal rates and stricter age-based fees | Long-term storage costs rise without clear alerts |

Dimensional weight | Greater reliance on automated size measurements | Minor dimension errors push products into higher fee tiers |

Category referral fees | More sub-category level fee structures | Misclassification leads to ongoing overcharges |

How do Amazon FBA audit tools detect fee losses?

Most Amazon sellers know fees exist, but very few can clearly see where fees go wrong. That is where Amazon FBA audit tools make a difference. They step in where manual tracking falls apart and bring clarity to fees that are otherwise easy to miss.

Instead of relying on surface-level Seller Central reports, these tools work in the background, cross-checking data that Amazon does not connect to you. The goal is simple: identify fee losses that look normal individually but are incorrect when validated end-to-end.

With Amazon FBA reconciliation tools like Refunzo, the process starts with reconciliation, not Amazon reimbursement claims. You connect your Seller Central account and run a comprehensive audit across more than 20 checkpoints. These checks cover inventory movements, fulfillment fees, storage fees, removals, returns, and processing charges.

This matters because many sellers only look at reimbursements, while real losses often sit in fee calculations that never trigger a refund alert.

#1 Automated audits across multiple fee categories

Refunzo scans your account across multiple fee types at once, not just lost or damaged inventory. It reviews backend data tied to Amazon FBA fee discrepancies, dimensional weight mismatches, storage fee calculations, and processing errors.

Because the audit runs at scale, it can spot patterns that manual reviews miss, like a recurring overcharge across multiple shipments or a single SKU repeatedly billed at the wrong size tier. Within minutes, sellers receive a detailed reconciliation report showing where Amazon may owe money, along with an estimated refund value. This first step is free for life, no card required, which lets sellers check inventory accuracy without risk.

#2 Human-reviewed validations

Automation finds issues fast, but accuracy still matters. Every potential discrepancy flagged by Refunzo is reviewed by an Amazon reimbursement specialist before a case is prepared. This step ensures claims align with Amazon’s latest reimbursement policies and reduces rejections.

Each case is handled individually, supported with the right data and documentation. This protects sellers from aggressive or incorrect claims while improving approval rates. It also means sellers are not guessing whether a charge is valid or not; the claim is backed by policy logic.

#3 Structured reporting for sellers

Clarity is where most sellers struggle. Refunzo solves this with clean, structured reporting. Sellers can clearly see recovered amounts, pending cases, and missed opportunities in one place. There is no digging across reports or spreadsheets.

Sellers can choose to file claims themselves using Refunzo’s data or let the team handle everything. If managed, the fee is 15% of recovered reimbursements, capped at $5,000. No recovery means no fee.

By combining automated audits, human validation, and transparent reporting, Refunzo turns fee recovery into a controlled, trustworthy process. For sellers scaling in 2026, this approach makes hidden fee losses visible, understandable, and recoverable.

Why does this affect your profits on Amazon?

Amazon applies fulfillment, storage, placement, and processing fees automatically; even tiny miscalculations affect every order.

Most sellers only check fees when profit feels “off,” by then months of loss are already baked in.

A $0.10–$0.20 fee error per unit looks harmless, but at scale, it outperforms bad ad spend in damage.

Fee-related margin compression usually shows up before performance metrics move.

FNSKU-level fees, dynamic storage rules, and automated decisions make spot checks unreliable.

Fee recovery returns confirmed money, no traffic, no bids, no algorithm risk.

Sellers who skip audits are not saving effort; they are accepting silent profit erosion.

Final words

Hidden fee losses are not a rare edge case anymore; they are part of how Amazon operates at scale in 2026. If fees are not actively checked, they are quietly accepted. Once the Amazon reimbursement claim windows close, that money is gone for good.

The good news is that it is one of the few margin problems sellers can actually control. You do not need more traffic, higher bids, or risky pricing changes. You need visibility. When fees are audited consistently, errors stop being invisible and start becoming recoverable cash.

That is where Amazon reimbursement software like Refunzo comes into play. It helps you see what Seller Central does not surface, verify what is correct, and recover what is not. If your margins feel tighter but sales look fine, do not guess. Run a reconciliation, see what is being missed, and decide with real numbers, not assumptions.

TL;DR

Hidden fee losses in Amazon FBA are common and often go unnoticed because fees are charged quietly and spread across multiple reports.

In 2026, more granular FBA and referral fee changes, automation, and higher SKU volume increase the risk of silent overcharges.

Small per-unit errors in fulfillment, storage, placement, or dimensional weight fees compound into significant margin loss at scale.

Amazon FBA audit tools reconcile disconnected Seller Central data to identify incorrect fees that never trigger alerts or refunds.

Combining automated audits with human validation improves accuracy and recovery rates under current reimbursement policies.

Regular fee audits recover confirmed profit without increasing ad spend, traffic, or pricing risk.

Selling on Amazon? Don’t let this hidden leak eat your profits.

Tiny fee errors, mis-scans, and incorrect charges that never trigger an alert, never show up as a red flag, and never get questioned. Because these costs sit behind the scenes, sellers naturally focus on what feels controllable: ads, PPC, storage, and pricing. Meanwhile, the real leak keeps running in the background. That is the invisible fee problem Amazon sellers miss.

In 2026, this problem will become harder to ignore. Amazon’s fees are more automated, more granular, and recalculated at scale. A few cents added to fulfillment or dimensional fees no longer feel small when multiplied across thousands of orders and multiple SKUs.

This is why an Amazon FBA audit tool for hidden fee recovery is no longer a “nice to have.” It acts as a visibility layer, connecting data that Seller Central keeps separate and showing sellers where money is slipping away. The Amazon FBA reconciliation tool helps sellers see the fees they are paying before those fees quietly become permanent margin loss.

What “hidden fee losses” actually mean in Amazon FBA

When sellers hear “hidden fee losses,” they often assume it means rare edge cases. In reality, these are everyday Amazon FBA fee discrepancies that never trigger alerts, emails, or warnings inside Seller Central. Amazon charges the fees quietly, and most sellers only notice when margins feel tighter month after month.

These losses usually come from fees that look normal in isolation but are wrong in context. Seller Central reports are fragmented; weight data sits in one place, fee previews in another, and reimbursements in a third. There is no single report that clearly says, “This charge was incorrect.” That is why Amazon FBA incorrect fee charges are so hard to catch manually.

The real problem is scale. A small Amazon dimensional weight error, say $0.30 extra per unit due to a wrong scan, feels harmless. But if you sell 2,000 units a month, that turns into $600 quietly gone. Multiply this across multiple ASINs and months, and the loss becomes significant without ever looking dramatic.

For example, a seller ships a standard-size product that weighs 450 g. After a mis-scan, Amazon bills it as oversized. Fulfillment fees jump by 20–50% per unit. The product still sells well, so no red flags appear. The seller only sees declining profit.

The same happens with Amazon storage fee overcharges, missing units that never get reimbursed, or processing penalties applied automatically. Without a dedicated audit, these issues stay invisible, yet they directly eat into your FBA profit in 2026.

Why are hidden fee losses increasing in 2026?

Hidden fee losses are not new on Amazon, but in 2026, they are happening more often and on a larger scale. The main reason is complexity. Amazon has announced changes to FBA and referral fees for 2026, which will take effect on January 15, 2026.

Amazon’s fee structure has expanded significantly over the last few years. Fulfillment fees, placement fees, storage charges, dimensional weight calculations, and category-based referral fees now interact in ways that are difficult to track manually.

At the same time, seller operations are moving faster. Brands are launching more SKUs, shipping inventory more frequently, and distributing stock across multiple fulfillment centers. With higher volume, even small fee mismatches become harder to notice. A few cents extra per unit does not raise alarms, but across thousands of orders, it quietly turns into a meaningful loss.

Another factor is automation on Amazon’s side. Fee calculations are increasingly system-driven, with fewer human checks. When errors happen, they often do not trigger notifications. Seller Central reports still show totals, but not always the “why” behind discrepancies, making fee issues easy to miss unless someone is actively looking.

Finally, internal seller teams are stretched thin. Ads, inventory planning, and compliance take priority, while backend fee accuracy is reviewed infrequently. As a result, errors go unchallenged until reimbursement claim windows close.

Fee type | What changed in 2026 | Why does it create hidden losses |

Fulfillment fees | More granular fee slabs based on size, weight, and handling | Small miscalculations per unit go unnoticed at scale |

Placement fees | Increased use of regional and split placement charges | Sellers struggle to reconcile fees across multiple FCs |

Storage charges | Higher seasonal rates and stricter age-based fees | Long-term storage costs rise without clear alerts |

Dimensional weight | Greater reliance on automated size measurements | Minor dimension errors push products into higher fee tiers |

Category referral fees | More sub-category level fee structures | Misclassification leads to ongoing overcharges |

How do Amazon FBA audit tools detect fee losses?

Most Amazon sellers know fees exist, but very few can clearly see where fees go wrong. That is where Amazon FBA audit tools make a difference. They step in where manual tracking falls apart and bring clarity to fees that are otherwise easy to miss.

Instead of relying on surface-level Seller Central reports, these tools work in the background, cross-checking data that Amazon does not connect to you. The goal is simple: identify fee losses that look normal individually but are incorrect when validated end-to-end.

With Amazon FBA reconciliation tools like Refunzo, the process starts with reconciliation, not Amazon reimbursement claims. You connect your Seller Central account and run a comprehensive audit across more than 20 checkpoints. These checks cover inventory movements, fulfillment fees, storage fees, removals, returns, and processing charges.

This matters because many sellers only look at reimbursements, while real losses often sit in fee calculations that never trigger a refund alert.

#1 Automated audits across multiple fee categories

Refunzo scans your account across multiple fee types at once, not just lost or damaged inventory. It reviews backend data tied to Amazon FBA fee discrepancies, dimensional weight mismatches, storage fee calculations, and processing errors.

Because the audit runs at scale, it can spot patterns that manual reviews miss, like a recurring overcharge across multiple shipments or a single SKU repeatedly billed at the wrong size tier. Within minutes, sellers receive a detailed reconciliation report showing where Amazon may owe money, along with an estimated refund value. This first step is free for life, no card required, which lets sellers check inventory accuracy without risk.

#2 Human-reviewed validations

Automation finds issues fast, but accuracy still matters. Every potential discrepancy flagged by Refunzo is reviewed by an Amazon reimbursement specialist before a case is prepared. This step ensures claims align with Amazon’s latest reimbursement policies and reduces rejections.

Each case is handled individually, supported with the right data and documentation. This protects sellers from aggressive or incorrect claims while improving approval rates. It also means sellers are not guessing whether a charge is valid or not; the claim is backed by policy logic.

#3 Structured reporting for sellers

Clarity is where most sellers struggle. Refunzo solves this with clean, structured reporting. Sellers can clearly see recovered amounts, pending cases, and missed opportunities in one place. There is no digging across reports or spreadsheets.

Sellers can choose to file claims themselves using Refunzo’s data or let the team handle everything. If managed, the fee is 15% of recovered reimbursements, capped at $5,000. No recovery means no fee.

By combining automated audits, human validation, and transparent reporting, Refunzo turns fee recovery into a controlled, trustworthy process. For sellers scaling in 2026, this approach makes hidden fee losses visible, understandable, and recoverable.

Why does this affect your profits on Amazon?

Amazon applies fulfillment, storage, placement, and processing fees automatically; even tiny miscalculations affect every order.

Most sellers only check fees when profit feels “off,” by then months of loss are already baked in.

A $0.10–$0.20 fee error per unit looks harmless, but at scale, it outperforms bad ad spend in damage.

Fee-related margin compression usually shows up before performance metrics move.

FNSKU-level fees, dynamic storage rules, and automated decisions make spot checks unreliable.

Fee recovery returns confirmed money, no traffic, no bids, no algorithm risk.

Sellers who skip audits are not saving effort; they are accepting silent profit erosion.

Final words

Hidden fee losses are not a rare edge case anymore; they are part of how Amazon operates at scale in 2026. If fees are not actively checked, they are quietly accepted. Once the Amazon reimbursement claim windows close, that money is gone for good.

The good news is that it is one of the few margin problems sellers can actually control. You do not need more traffic, higher bids, or risky pricing changes. You need visibility. When fees are audited consistently, errors stop being invisible and start becoming recoverable cash.

That is where Amazon reimbursement software like Refunzo comes into play. It helps you see what Seller Central does not surface, verify what is correct, and recover what is not. If your margins feel tighter but sales look fine, do not guess. Run a reconciliation, see what is being missed, and decide with real numbers, not assumptions.

Related post

Amazon FBA Reimbursements

Amazon underpaid your reimbursement? Refunzo finds your missing money automatically

Amazon underpaid your reimbursement? Refunzo finds your missing money automatically

Amazon underpaid your reimbursement? Refunzo finds your missing money automatically

Amazon underpaid your reimbursement? Refunzo finds your missing money automatically

Feb 12, 2026

|

12min

Reimbursement Claim

Never miss Amazon’s 60-day reimbursement claim window: A weekly reconciliation SOP

Never miss Amazon’s 60-day reimbursement claim window: A weekly reconciliation SOP

Never miss Amazon’s 60-day reimbursement claim window: A weekly reconciliation SOP

Never miss Amazon’s 60-day reimbursement claim window: A weekly reconciliation SOP

Feb 4, 2026

|

15 min

Amazon Reimbursement

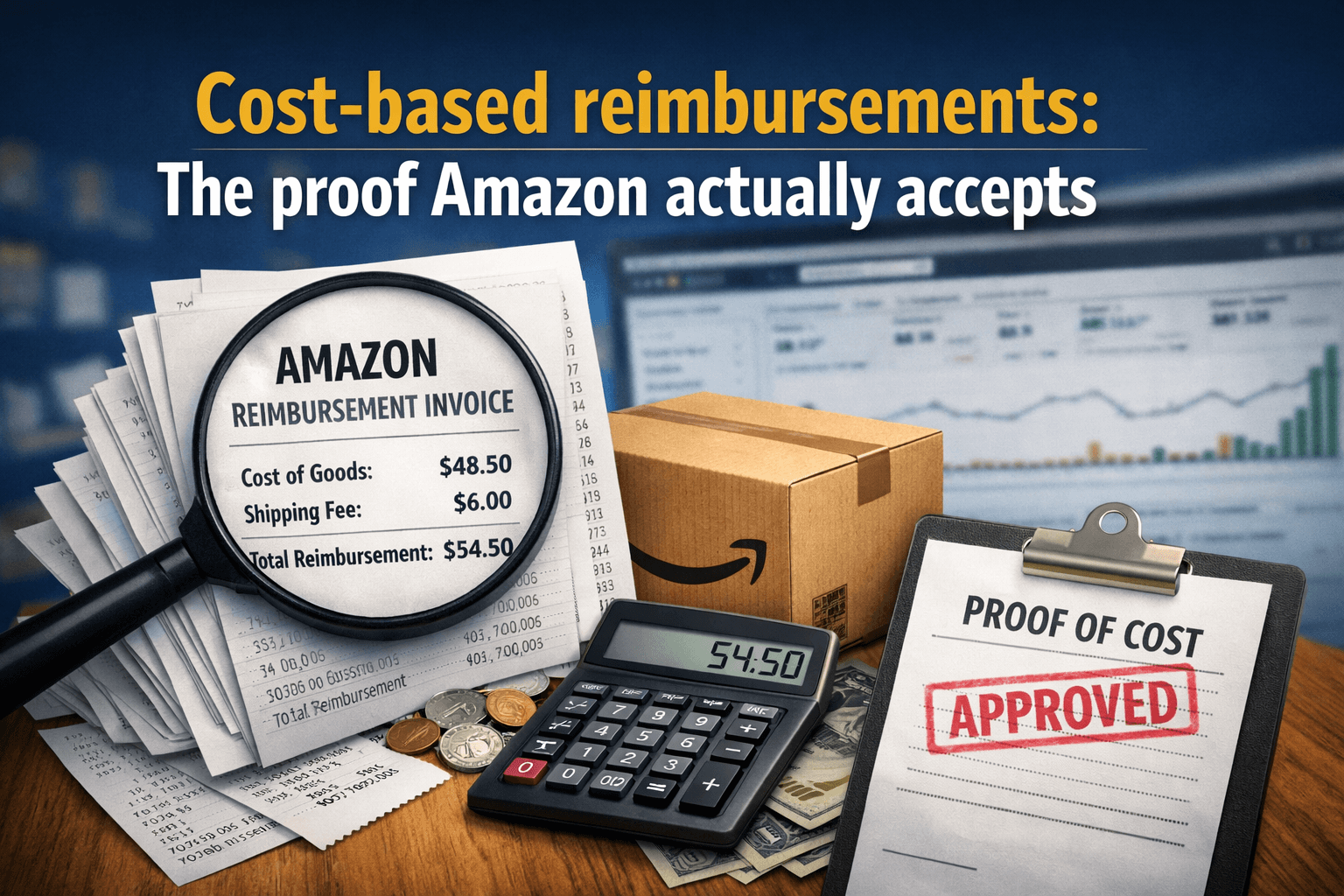

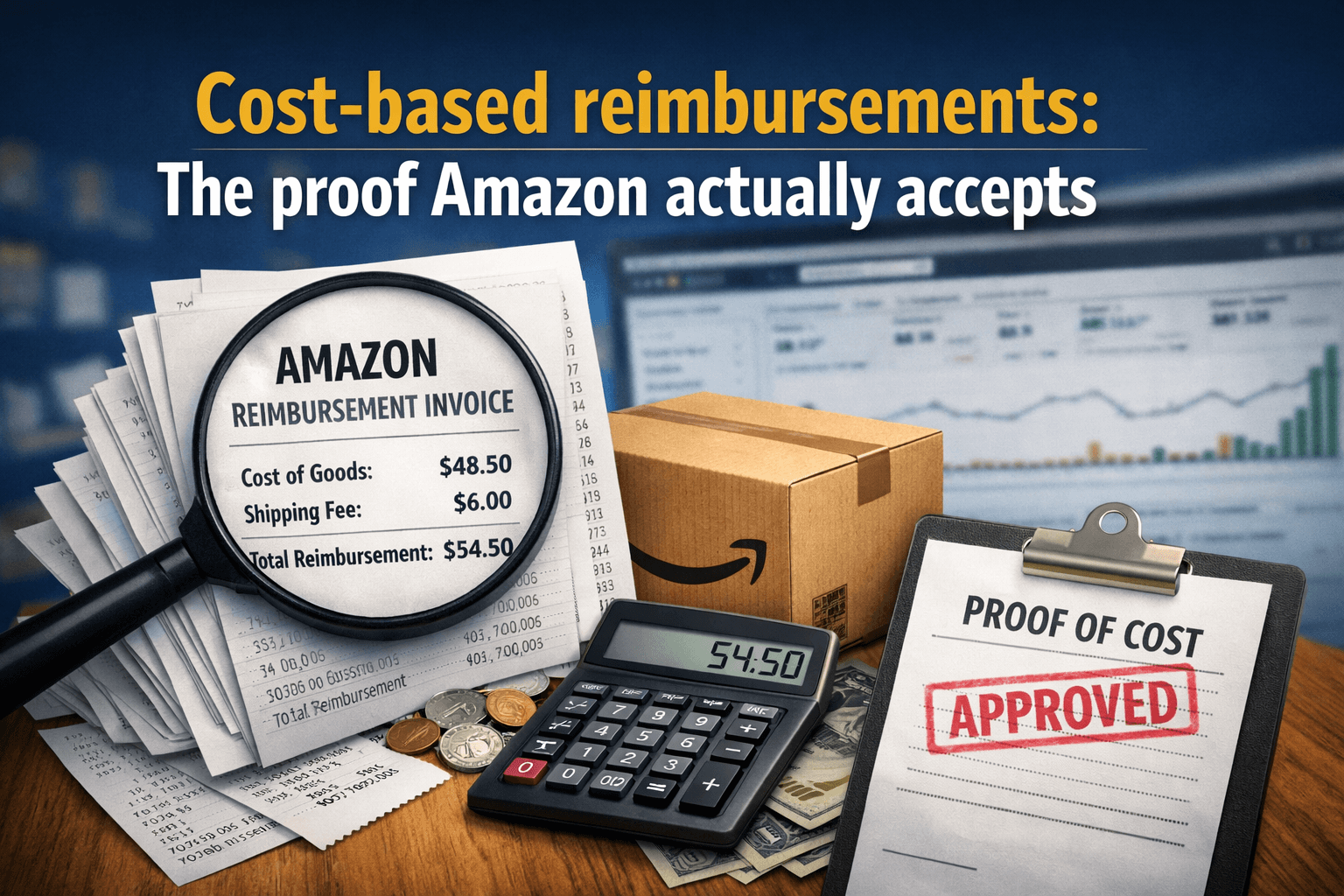

Cost-based reimbursements: The proof Amazon actually accepts

Cost-based reimbursements: The proof Amazon actually accepts

Cost-based reimbursements: The proof Amazon actually accepts

Cost-based reimbursements: The proof Amazon actually accepts

Jan 31, 2026

|

12 min

Stay updated by subscribing

to our newsletter.

Stay updated by subscribing

to our newsletter.

Stay informed and up-to-date with the latest news and updates

from our company by subscribing to our newsletter.

Stay informed and up-to-date

with the latest news and updates

from our company by subscribing to

our newsletter.