Cost-based reimbursements: The proof Amazon actually accepts

Jan 31, 2026

Jan 31, 2026

Jan 31, 2026

TL;DR

Amazon usually reimburses inventory issues based on your unit cost, not your selling price, which is why payouts often look lower than expected.

Cost-based reimbursements apply to lost, damaged, shorted, removed, or refund-related inventory problems.

Most claim denials happen due to unclear or incomplete invoices, poor product matching (SKU, ASIN, FNSKU), or bundled costs that are hard to verify.

Strong claims combine system proof (Amazon reports, shipment data, refunds) with clear cost proof (invoice, PO, unit cost breakdown).

Showing a simple, one-page cost breakdown with clear unit math significantly improves approval speed.

Tools like Refunzo help sellers identify reimbursement gaps and submit clean, cost-backed claims without manual effort.

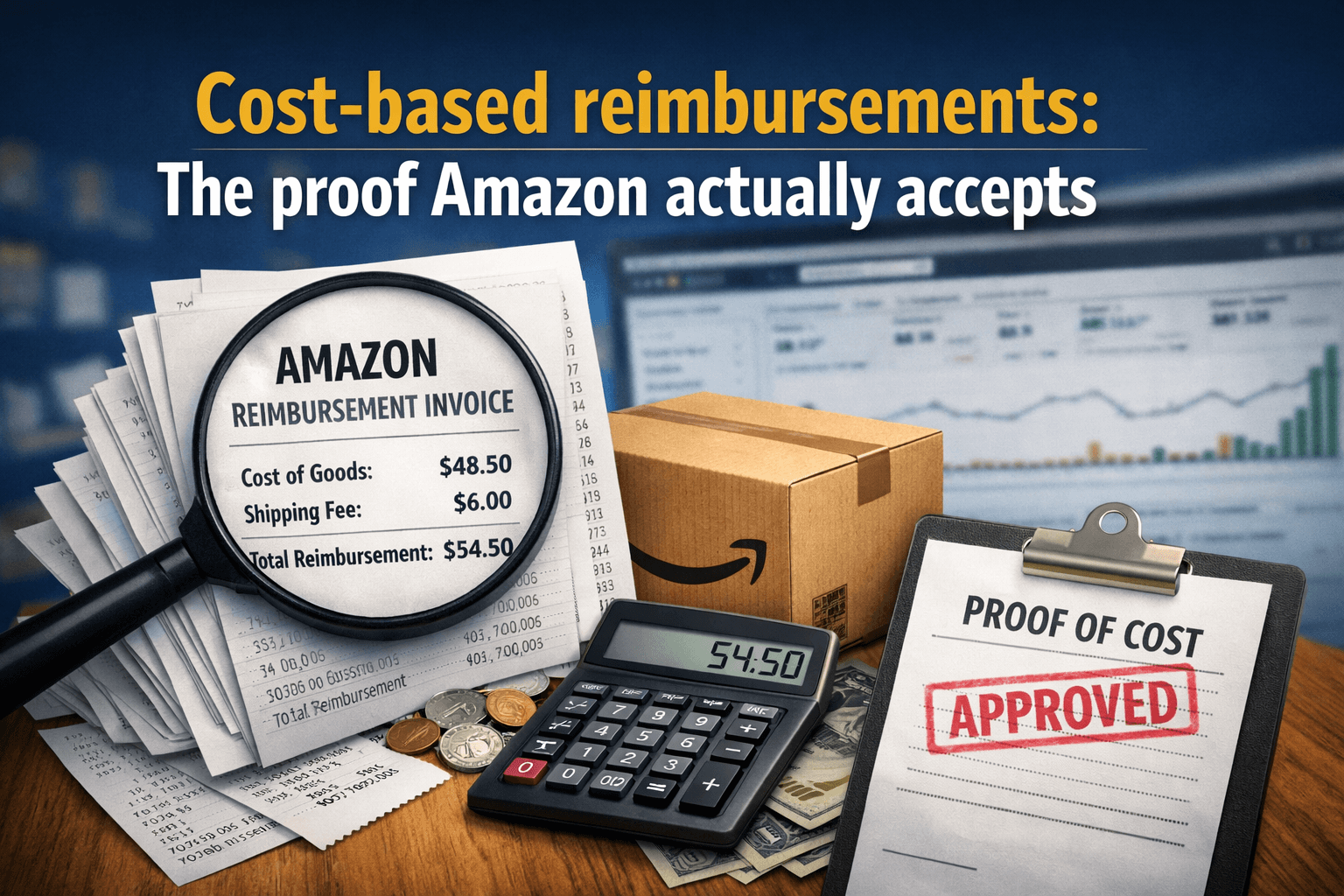

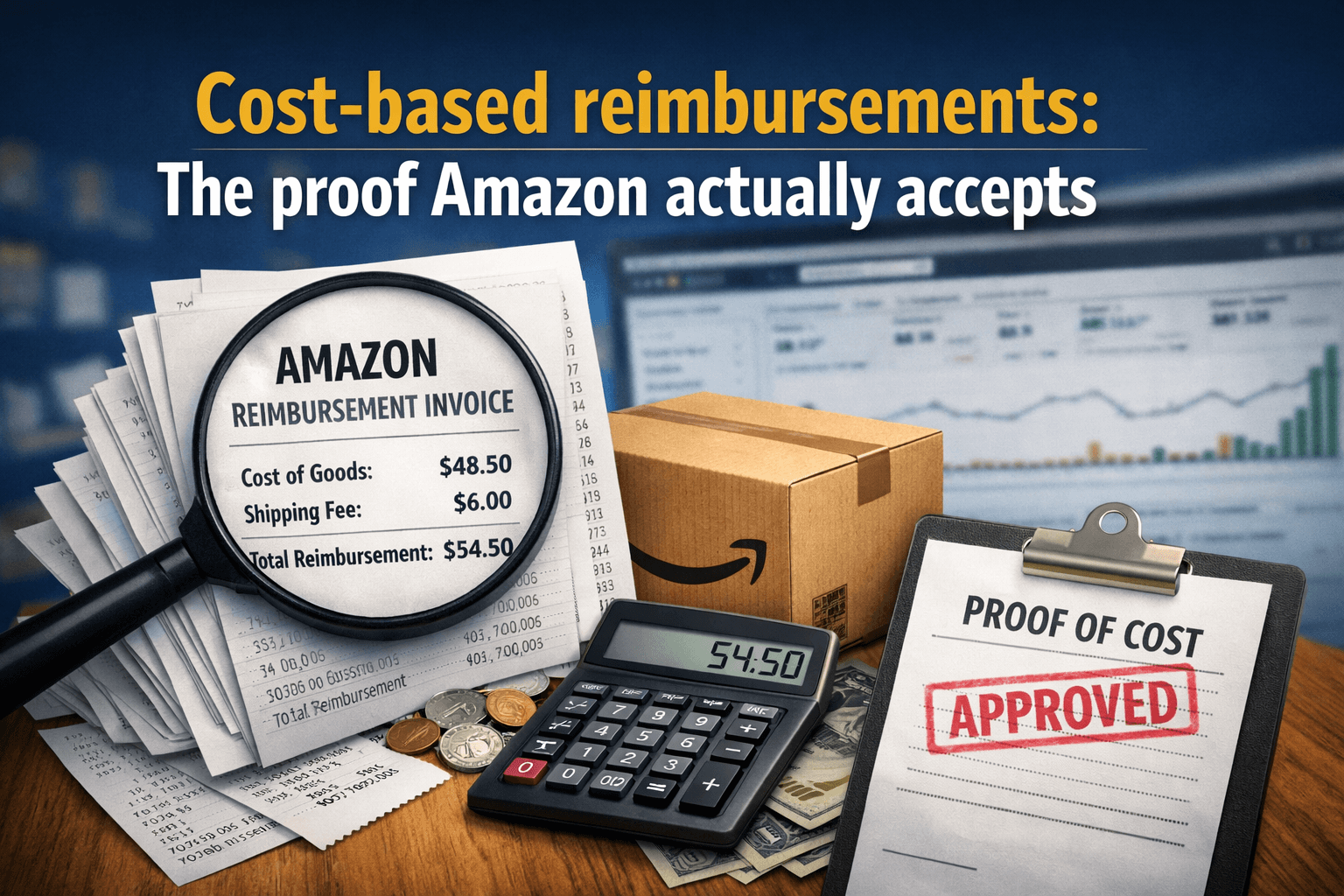

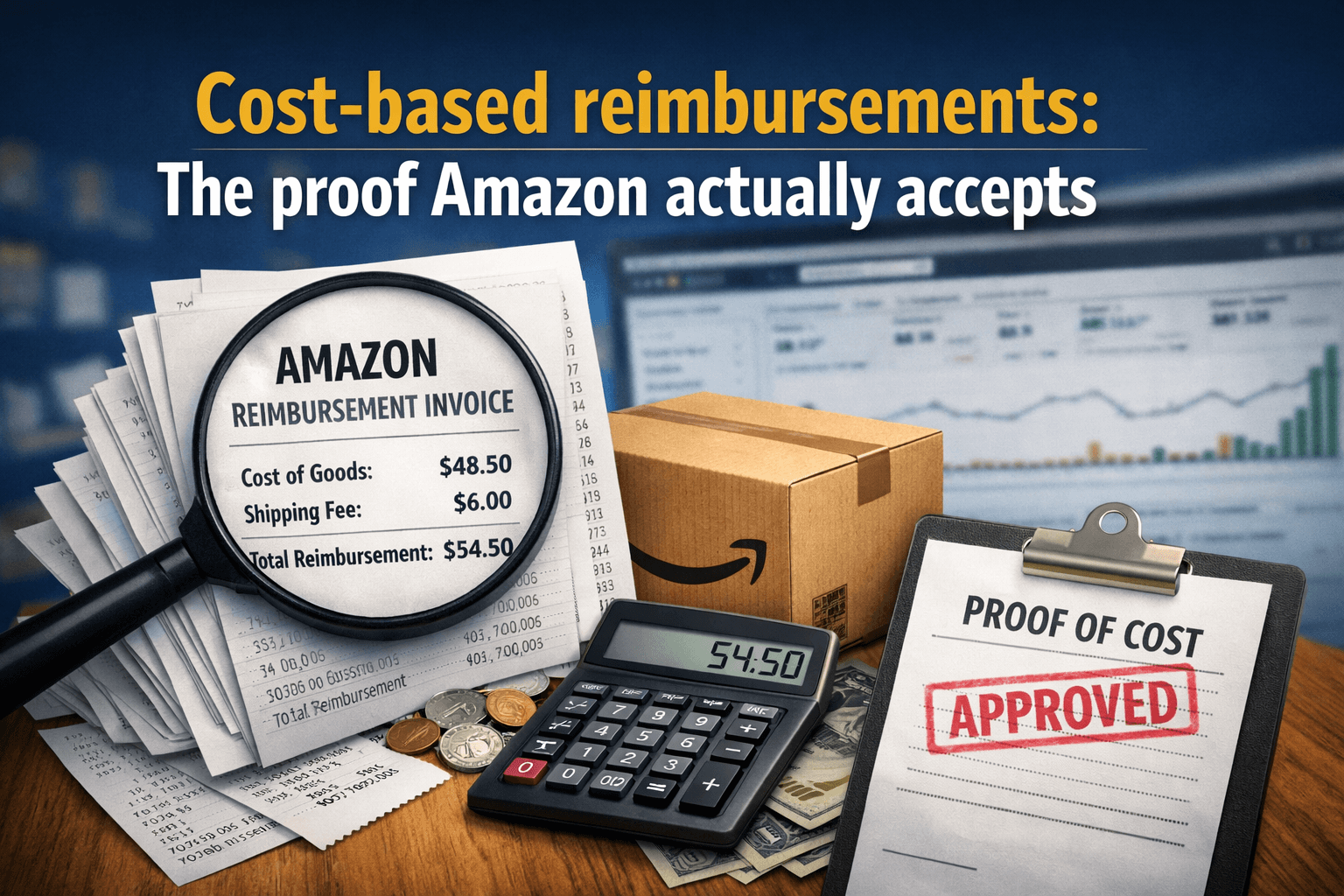

Ever filed an Amazon reimbursement claim and felt confused when the amount didn't match what you expected? Here's what most sellers don't realize. Amazon usually reimburses based on your cost, not your selling price.

Understanding Amazon reimbursement cost-based rules and preparing the right documents can make the difference between a quick approval and weeks of back-and-forth frustration.

This blog explains what cost-based reimbursement means, when you need it, and exactly how to prove manufacturing costs for Amazon reimbursement using documents that Amazon actually accepts.

What is an Amazon cost-based reimbursement?

A cost-based reimbursement Amazon claim is when Amazon pays you back for inventory problems (lost, damaged, shorted, or refund issues) using your actual cost instead of your retail price. This is why reimbursements sometimes look different from what sellers expect. Amazon isn't paying for your profit margin; they're reimbursing based on what the inventory costs you.

This also explains why sellers often hear: Amazon asks for invoice reimbursement. When your case depends on proving cost, invoices are the most common and most trusted proof.

When does Amazon use cost-based reimbursements?

Amazon sellers deal with reimbursement based on cost. Amazon’s situations when inventory goes wrong:

Lost inventory in an Amazon warehouse

Damaged inventory at the fulfillment center

Inbound shipment shortages (you shipped 100 units, Amazon received only 95)

Removal or disposal issues (inventory removed incorrectly)

Refund problems (the customer got refunded, but the inventory wasn't returned)

These cases aren't just something that went wrong; and they're here's what went wrong, and here's the unit cost you should reimburse.

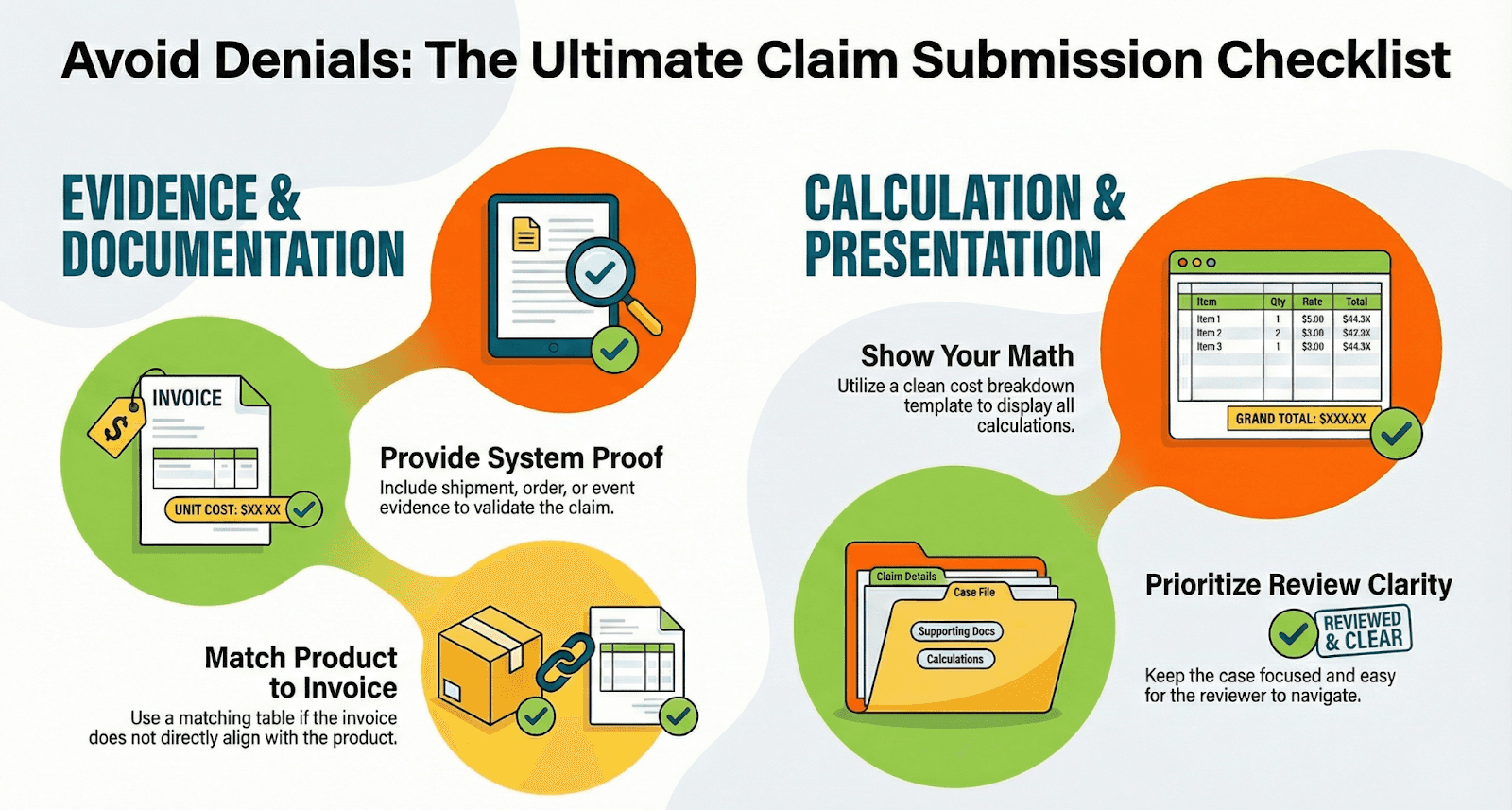

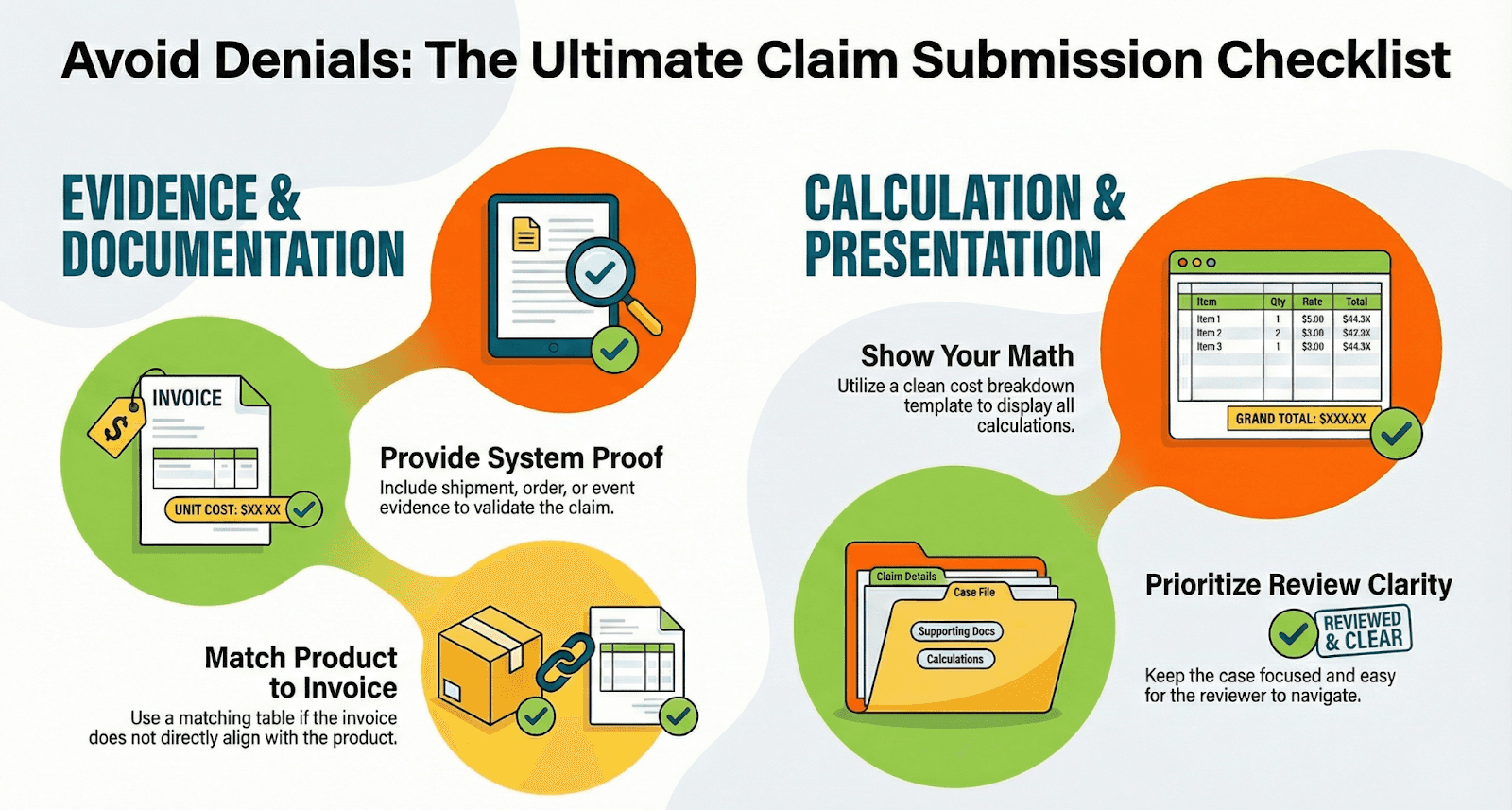

Why Amazon denies cost-based reimbursement claims (How to avoid it)

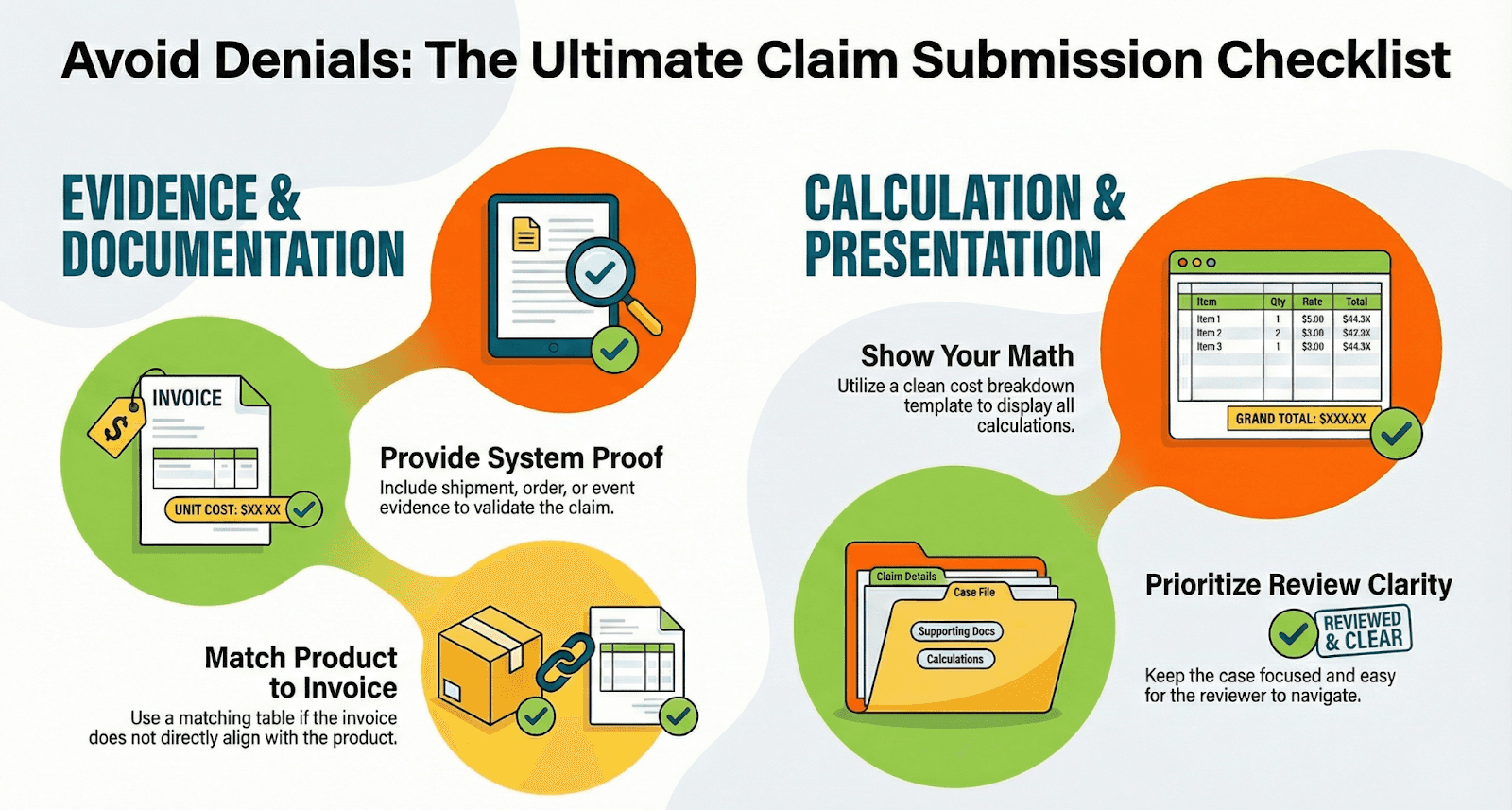

Most denials don't happen because you're wrong. They happen because your proof is incomplete, confusing, or doesn't match up. Here are the most common problems:

1. Invoice doesn't clearly match your product

Amazon support needs to see that your cost document actually applies to the exact product you're claiming for. Include a simple table showing how your manufacturer's product code matches your Amazon ASIN/FNSKU.

2. Invoice is missing important information

If your invoice doesn't show basics like supplier name, date, quantity, and unit cost, you'll probably get rejected. Ask your supplier for a corrected invoice, or provide both your purchase order and invoice together.

3. The cost is unclear or bundled

If your cost includes shipping, duties, discounts, or multiple products mixed without clear per-unit costs, Amazon may reject it. Provide a clean Amazon reimbursement cost breakdown template showing simple math on one page.

4. Too many issues in one case

Trying to claim multiple products or multiple problem types in one case can confuse the reviewer. Keep cases simple, and one issue type per case when possible, and only group claims when your documentation is consistent.

Proof that wins: The complete documentation package

To make your claim easy to approve, think in layers. The best claims include both types of proof:

#1 System proof

This is evidence from Amazon's system showing the problem. It includes:

Shipment ID proof (what you shipped vs. what Amazon received)

Inventory event reports (showing lost or damaged items)

Order ID or refund proof (refund issued, return status, etc.)

Relevant dates

#2 Cost proof

This is where most sellers struggle. Your goal is to show a credible unit cost using:

Supplier invoice or manufacturer invoice

Purchase order (PO) (helpful supporting document)

Proof of payment (sometimes requested)

Packing list or bill of lading (for shipping disputes)

How to prove manufacturing cost for Amazon reimbursement (Step-by-step)

If you manufacture your own product (private label), you might not have a traditional "wholesale invoice." Amazon just needs a credible cost document that is consistent, traceable to your product, and shows per-unit cost clearly. Here's how to package your manufacturing cost proof so it works:

Step 1: Use your best source document

Start with the most credible document you have:

Manufacturer invoice showing product, quantity, and unit price (best)

Purchase order + manufacturer invoice (great combo)

Commercial invoice (common for international shipments)

If needed: cost letter from manufacturer with supporting paperwork

Step 2: Make product identification crystal clear

Your invoice might show your factory's internal product code, while Amazon uses ASIN and FNSKU.

Create a simple matching table like this:

Manufacturer SKU: ABC-100

Your internal SKU: RFZ-ABC-100

Amazon ASIN: B0XXXXXXX

FNSKU: X00XXXXX

Step 3: Show unit cost clearly

If your invoice already shows the unit price, great. If it only shows totals, calculate unit cost simply: Unit cost = Total amount ÷ Quantity. Don't make the support agent do math. If they have to calculate it themselves, it delays your approval.

Step 4: Separate product cost from extra charges

Your manufacturing cost might be separate from shipping, duties, inspection fees, etc. If you want to include these extras, do it clearly:

List them separately

Allocate them consistently

Show your calculation

If you're unsure, present:

Product unit cost (from invoice) as the main number

Extra costs as an optional supporting detail if Amazon requests it

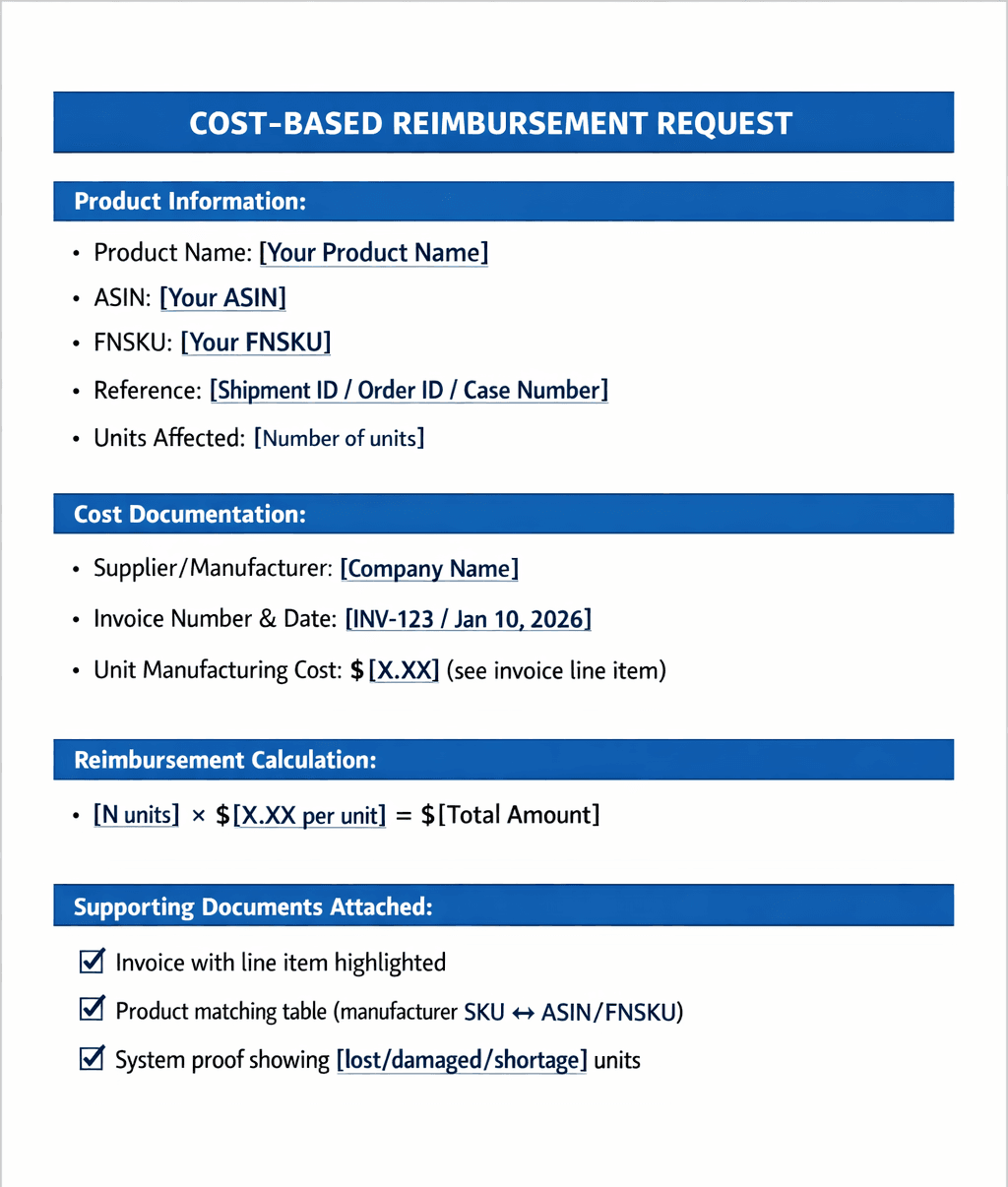

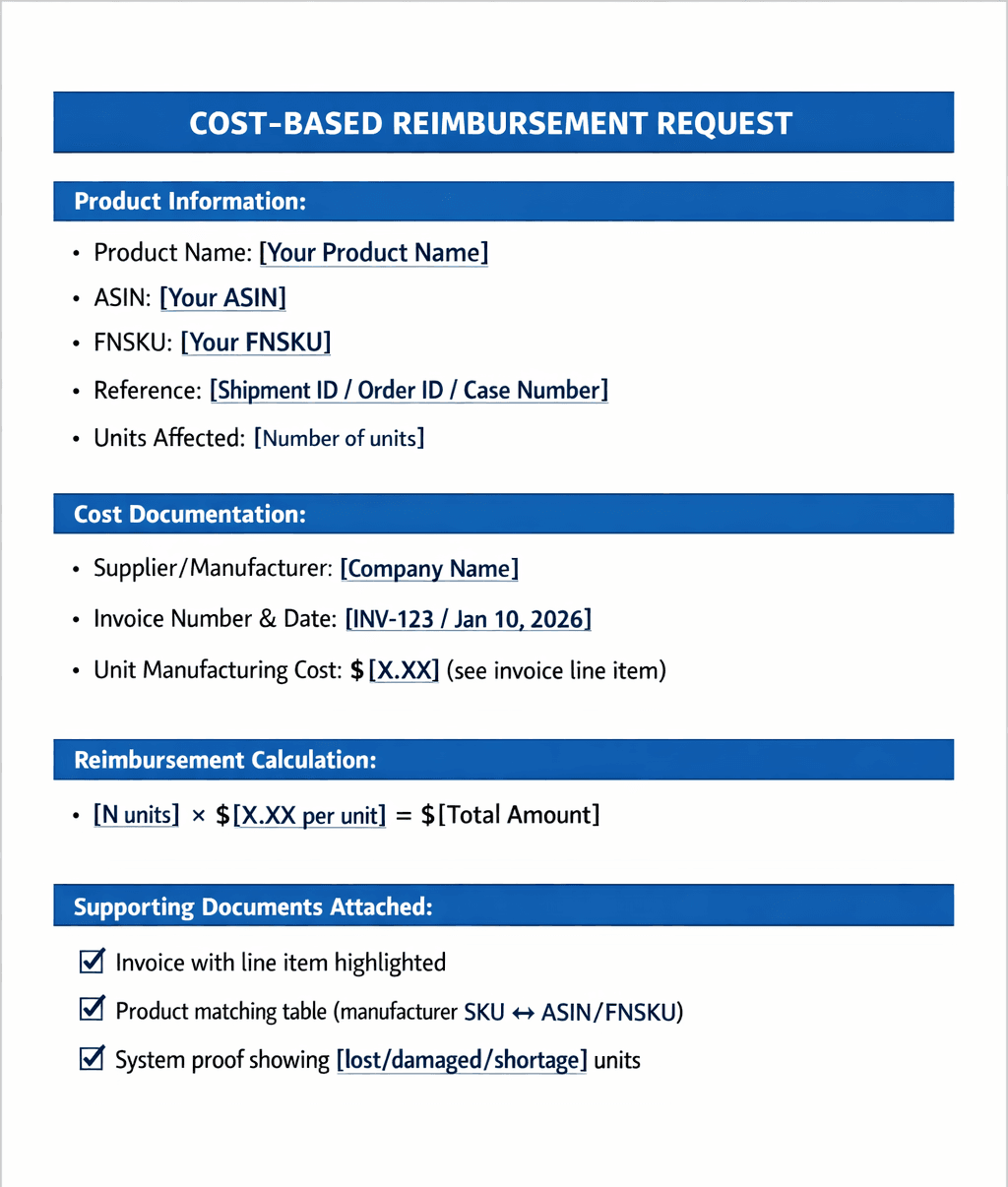

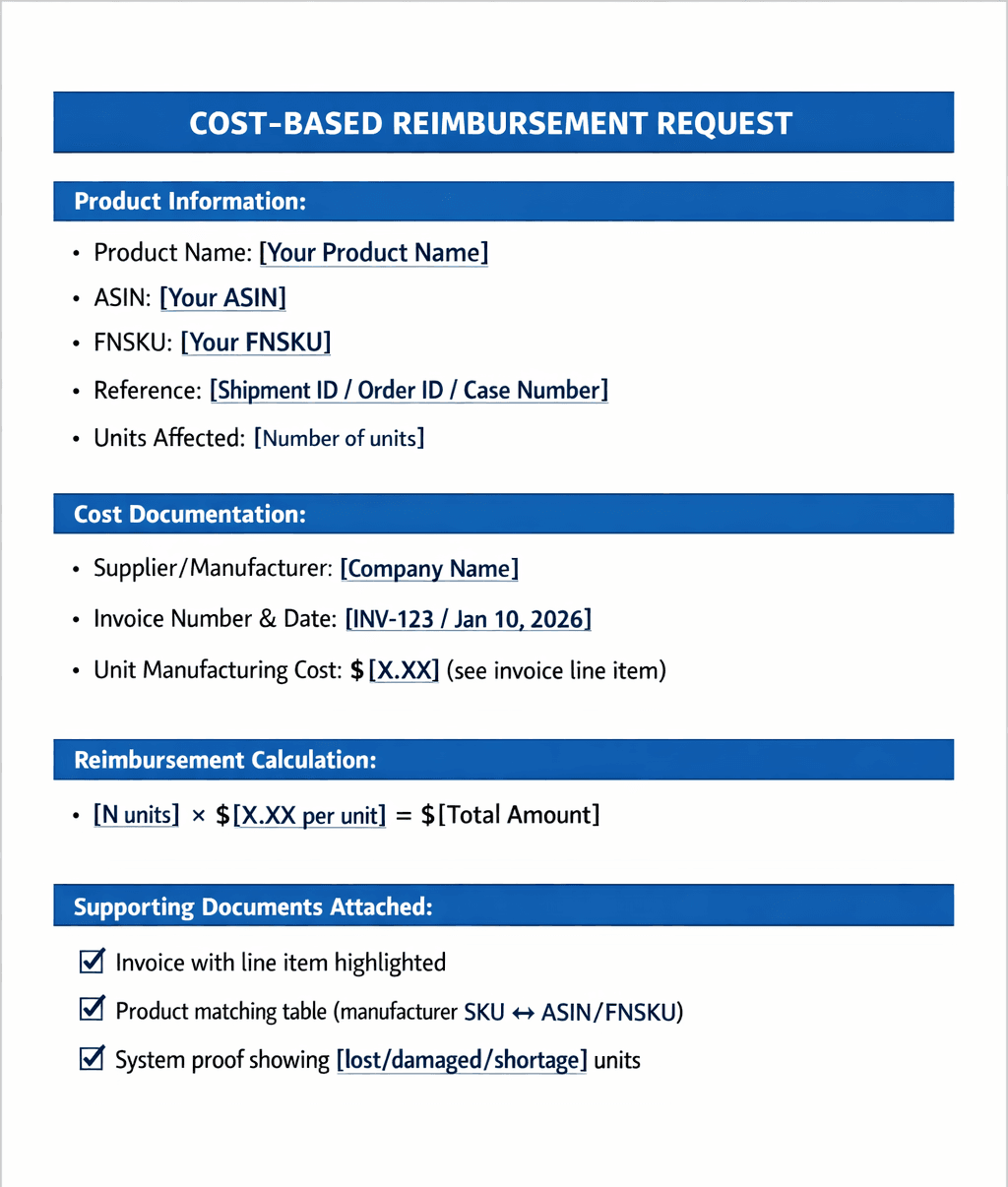

Step 5: Create a one-page "proof pack"

Support teams work fast. Your job is to make their decision easy. A clean proof pack includes:

Claim summary (product, units, what happened, dates, amount requested)

Invoice page with the relevant line highlighted

Screenshot or report showing the inventory problem

One-page cost breakdown

Amazon reimbursement cost breakdown template

What to do when Amazon asks for invoice reimbursement (But you don't have one)

Sometimes sellers source from:

Liquidation sales

Retail arbitrage

Mixed supplier channels

Older inventory with missing records

If Amazon asks for invoice reimbursement and you don't have a perfect invoice, try these options:

Request a duplicate invoice from your supplier (often the fastest solution)

Provide a purchase order + payment proof if the invoice is missing details

Get a commercial invoice from the freight forwarder if you used one for importing

Build the cost breakdown so even imperfect documents are easier to understand

Case-writing tips for cost-based reimbursement claim

Even with the right documents, how you write your message matters. Keep your case text short, structured, and specific. Use this simple format:

State the problem

Provide reference

Request action

Attach proof

How Refunzo helps you win cost-based reimbursements (Without the manual work)

Cost-based cases are absolutely winnable, but they’re also time-consuming. You first have to identify the discrepancy, then gather the right proof, match the correct product codes, and finally present clean, accurate calculations that Amazon can actually accept.

Each step demands precision, and missing even one detail can delay or derail the reimbursement entirely. Refunzo makes this process much easier for Amazon FBA sellers:

Run a lifetime-free reconciliation across 20+ potential problem areas

Get a clear, detailed report showing exactly what Amazon may owe you

Choose how you want to proceed with the claims yourself using accurate, ready-to-submit

data or let Refunzo handle everything for a simple success fee that is 15% of the recovered amount (capped at $5,000

Your goal is not to let cost-based reimbursements become a profit leak. Get back what's yours with proof that wins.

Final checklist before you submit a cost-based reimbursement claim

Ready to see what Amazon owes you?

If you suspect lost, damaged, or shorted inventory has been eating into your profits, run your free Amazon reconciliation audit with Refunzo and get a clear report. Then decide whether you want to file claims yourself or let us handle the work.

You've already done the hard part: building a business. Because every dollar you’re owed should end up back in your account.

TL;DR

Amazon usually reimburses inventory issues based on your unit cost, not your selling price, which is why payouts often look lower than expected.

Cost-based reimbursements apply to lost, damaged, shorted, removed, or refund-related inventory problems.

Most claim denials happen due to unclear or incomplete invoices, poor product matching (SKU, ASIN, FNSKU), or bundled costs that are hard to verify.

Strong claims combine system proof (Amazon reports, shipment data, refunds) with clear cost proof (invoice, PO, unit cost breakdown).

Showing a simple, one-page cost breakdown with clear unit math significantly improves approval speed.

Tools like Refunzo help sellers identify reimbursement gaps and submit clean, cost-backed claims without manual effort.

Ever filed an Amazon reimbursement claim and felt confused when the amount didn't match what you expected? Here's what most sellers don't realize. Amazon usually reimburses based on your cost, not your selling price.

Understanding Amazon reimbursement cost-based rules and preparing the right documents can make the difference between a quick approval and weeks of back-and-forth frustration.

This blog explains what cost-based reimbursement means, when you need it, and exactly how to prove manufacturing costs for Amazon reimbursement using documents that Amazon actually accepts.

What is an Amazon cost-based reimbursement?

A cost-based reimbursement Amazon claim is when Amazon pays you back for inventory problems (lost, damaged, shorted, or refund issues) using your actual cost instead of your retail price. This is why reimbursements sometimes look different from what sellers expect. Amazon isn't paying for your profit margin; they're reimbursing based on what the inventory costs you.

This also explains why sellers often hear: Amazon asks for invoice reimbursement. When your case depends on proving cost, invoices are the most common and most trusted proof.

When does Amazon use cost-based reimbursements?

Amazon sellers deal with reimbursement based on cost. Amazon’s situations when inventory goes wrong:

Lost inventory in an Amazon warehouse

Damaged inventory at the fulfillment center

Inbound shipment shortages (you shipped 100 units, Amazon received only 95)

Removal or disposal issues (inventory removed incorrectly)

Refund problems (the customer got refunded, but the inventory wasn't returned)

These cases aren't just something that went wrong; and they're here's what went wrong, and here's the unit cost you should reimburse.

Why Amazon denies cost-based reimbursement claims (How to avoid it)

Most denials don't happen because you're wrong. They happen because your proof is incomplete, confusing, or doesn't match up. Here are the most common problems:

1. Invoice doesn't clearly match your product

Amazon support needs to see that your cost document actually applies to the exact product you're claiming for. Include a simple table showing how your manufacturer's product code matches your Amazon ASIN/FNSKU.

2. Invoice is missing important information

If your invoice doesn't show basics like supplier name, date, quantity, and unit cost, you'll probably get rejected. Ask your supplier for a corrected invoice, or provide both your purchase order and invoice together.

3. The cost is unclear or bundled

If your cost includes shipping, duties, discounts, or multiple products mixed without clear per-unit costs, Amazon may reject it. Provide a clean Amazon reimbursement cost breakdown template showing simple math on one page.

4. Too many issues in one case

Trying to claim multiple products or multiple problem types in one case can confuse the reviewer. Keep cases simple, and one issue type per case when possible, and only group claims when your documentation is consistent.

Proof that wins: The complete documentation package

To make your claim easy to approve, think in layers. The best claims include both types of proof:

#1 System proof

This is evidence from Amazon's system showing the problem. It includes:

Shipment ID proof (what you shipped vs. what Amazon received)

Inventory event reports (showing lost or damaged items)

Order ID or refund proof (refund issued, return status, etc.)

Relevant dates

#2 Cost proof

This is where most sellers struggle. Your goal is to show a credible unit cost using:

Supplier invoice or manufacturer invoice

Purchase order (PO) (helpful supporting document)

Proof of payment (sometimes requested)

Packing list or bill of lading (for shipping disputes)

How to prove manufacturing cost for Amazon reimbursement (Step-by-step)

If you manufacture your own product (private label), you might not have a traditional "wholesale invoice." Amazon just needs a credible cost document that is consistent, traceable to your product, and shows per-unit cost clearly. Here's how to package your manufacturing cost proof so it works:

Step 1: Use your best source document

Start with the most credible document you have:

Manufacturer invoice showing product, quantity, and unit price (best)

Purchase order + manufacturer invoice (great combo)

Commercial invoice (common for international shipments)

If needed: cost letter from manufacturer with supporting paperwork

Step 2: Make product identification crystal clear

Your invoice might show your factory's internal product code, while Amazon uses ASIN and FNSKU.

Create a simple matching table like this:

Manufacturer SKU: ABC-100

Your internal SKU: RFZ-ABC-100

Amazon ASIN: B0XXXXXXX

FNSKU: X00XXXXX

Step 3: Show unit cost clearly

If your invoice already shows the unit price, great. If it only shows totals, calculate unit cost simply: Unit cost = Total amount ÷ Quantity. Don't make the support agent do math. If they have to calculate it themselves, it delays your approval.

Step 4: Separate product cost from extra charges

Your manufacturing cost might be separate from shipping, duties, inspection fees, etc. If you want to include these extras, do it clearly:

List them separately

Allocate them consistently

Show your calculation

If you're unsure, present:

Product unit cost (from invoice) as the main number

Extra costs as an optional supporting detail if Amazon requests it

Step 5: Create a one-page "proof pack"

Support teams work fast. Your job is to make their decision easy. A clean proof pack includes:

Claim summary (product, units, what happened, dates, amount requested)

Invoice page with the relevant line highlighted

Screenshot or report showing the inventory problem

One-page cost breakdown

Amazon reimbursement cost breakdown template

What to do when Amazon asks for invoice reimbursement (But you don't have one)

Sometimes sellers source from:

Liquidation sales

Retail arbitrage

Mixed supplier channels

Older inventory with missing records

If Amazon asks for invoice reimbursement and you don't have a perfect invoice, try these options:

Request a duplicate invoice from your supplier (often the fastest solution)

Provide a purchase order + payment proof if the invoice is missing details

Get a commercial invoice from the freight forwarder if you used one for importing

Build the cost breakdown so even imperfect documents are easier to understand

Case-writing tips for cost-based reimbursement claim

Even with the right documents, how you write your message matters. Keep your case text short, structured, and specific. Use this simple format:

State the problem

Provide reference

Request action

Attach proof

How Refunzo helps you win cost-based reimbursements (Without the manual work)

Cost-based cases are absolutely winnable, but they’re also time-consuming. You first have to identify the discrepancy, then gather the right proof, match the correct product codes, and finally present clean, accurate calculations that Amazon can actually accept.

Each step demands precision, and missing even one detail can delay or derail the reimbursement entirely. Refunzo makes this process much easier for Amazon FBA sellers:

Run a lifetime-free reconciliation across 20+ potential problem areas

Get a clear, detailed report showing exactly what Amazon may owe you

Choose how you want to proceed with the claims yourself using accurate, ready-to-submit

data or let Refunzo handle everything for a simple success fee that is 15% of the recovered amount (capped at $5,000

Your goal is not to let cost-based reimbursements become a profit leak. Get back what's yours with proof that wins.

Final checklist before you submit a cost-based reimbursement claim

Ready to see what Amazon owes you?

If you suspect lost, damaged, or shorted inventory has been eating into your profits, run your free Amazon reconciliation audit with Refunzo and get a clear report. Then decide whether you want to file claims yourself or let us handle the work.

You've already done the hard part: building a business. Because every dollar you’re owed should end up back in your account.

TL;DR

Amazon usually reimburses inventory issues based on your unit cost, not your selling price, which is why payouts often look lower than expected.

Cost-based reimbursements apply to lost, damaged, shorted, removed, or refund-related inventory problems.

Most claim denials happen due to unclear or incomplete invoices, poor product matching (SKU, ASIN, FNSKU), or bundled costs that are hard to verify.

Strong claims combine system proof (Amazon reports, shipment data, refunds) with clear cost proof (invoice, PO, unit cost breakdown).

Showing a simple, one-page cost breakdown with clear unit math significantly improves approval speed.

Tools like Refunzo help sellers identify reimbursement gaps and submit clean, cost-backed claims without manual effort.

Ever filed an Amazon reimbursement claim and felt confused when the amount didn't match what you expected? Here's what most sellers don't realize. Amazon usually reimburses based on your cost, not your selling price.

Understanding Amazon reimbursement cost-based rules and preparing the right documents can make the difference between a quick approval and weeks of back-and-forth frustration.

This blog explains what cost-based reimbursement means, when you need it, and exactly how to prove manufacturing costs for Amazon reimbursement using documents that Amazon actually accepts.

What is an Amazon cost-based reimbursement?

A cost-based reimbursement Amazon claim is when Amazon pays you back for inventory problems (lost, damaged, shorted, or refund issues) using your actual cost instead of your retail price. This is why reimbursements sometimes look different from what sellers expect. Amazon isn't paying for your profit margin; they're reimbursing based on what the inventory costs you.

This also explains why sellers often hear: Amazon asks for invoice reimbursement. When your case depends on proving cost, invoices are the most common and most trusted proof.

When does Amazon use cost-based reimbursements?

Amazon sellers deal with reimbursement based on cost. Amazon’s situations when inventory goes wrong:

Lost inventory in an Amazon warehouse

Damaged inventory at the fulfillment center

Inbound shipment shortages (you shipped 100 units, Amazon received only 95)

Removal or disposal issues (inventory removed incorrectly)

Refund problems (the customer got refunded, but the inventory wasn't returned)

These cases aren't just something that went wrong; and they're here's what went wrong, and here's the unit cost you should reimburse.

Why Amazon denies cost-based reimbursement claims (How to avoid it)

Most denials don't happen because you're wrong. They happen because your proof is incomplete, confusing, or doesn't match up. Here are the most common problems:

1. Invoice doesn't clearly match your product

Amazon support needs to see that your cost document actually applies to the exact product you're claiming for. Include a simple table showing how your manufacturer's product code matches your Amazon ASIN/FNSKU.

2. Invoice is missing important information

If your invoice doesn't show basics like supplier name, date, quantity, and unit cost, you'll probably get rejected. Ask your supplier for a corrected invoice, or provide both your purchase order and invoice together.

3. The cost is unclear or bundled

If your cost includes shipping, duties, discounts, or multiple products mixed without clear per-unit costs, Amazon may reject it. Provide a clean Amazon reimbursement cost breakdown template showing simple math on one page.

4. Too many issues in one case

Trying to claim multiple products or multiple problem types in one case can confuse the reviewer. Keep cases simple, and one issue type per case when possible, and only group claims when your documentation is consistent.

Proof that wins: The complete documentation package

To make your claim easy to approve, think in layers. The best claims include both types of proof:

#1 System proof

This is evidence from Amazon's system showing the problem. It includes:

Shipment ID proof (what you shipped vs. what Amazon received)

Inventory event reports (showing lost or damaged items)

Order ID or refund proof (refund issued, return status, etc.)

Relevant dates

#2 Cost proof

This is where most sellers struggle. Your goal is to show a credible unit cost using:

Supplier invoice or manufacturer invoice

Purchase order (PO) (helpful supporting document)

Proof of payment (sometimes requested)

Packing list or bill of lading (for shipping disputes)

How to prove manufacturing cost for Amazon reimbursement (Step-by-step)

If you manufacture your own product (private label), you might not have a traditional "wholesale invoice." Amazon just needs a credible cost document that is consistent, traceable to your product, and shows per-unit cost clearly. Here's how to package your manufacturing cost proof so it works:

Step 1: Use your best source document

Start with the most credible document you have:

Manufacturer invoice showing product, quantity, and unit price (best)

Purchase order + manufacturer invoice (great combo)

Commercial invoice (common for international shipments)

If needed: cost letter from manufacturer with supporting paperwork

Step 2: Make product identification crystal clear

Your invoice might show your factory's internal product code, while Amazon uses ASIN and FNSKU.

Create a simple matching table like this:

Manufacturer SKU: ABC-100

Your internal SKU: RFZ-ABC-100

Amazon ASIN: B0XXXXXXX

FNSKU: X00XXXXX

Step 3: Show unit cost clearly

If your invoice already shows the unit price, great. If it only shows totals, calculate unit cost simply: Unit cost = Total amount ÷ Quantity. Don't make the support agent do math. If they have to calculate it themselves, it delays your approval.

Step 4: Separate product cost from extra charges

Your manufacturing cost might be separate from shipping, duties, inspection fees, etc. If you want to include these extras, do it clearly:

List them separately

Allocate them consistently

Show your calculation

If you're unsure, present:

Product unit cost (from invoice) as the main number

Extra costs as an optional supporting detail if Amazon requests it

Step 5: Create a one-page "proof pack"

Support teams work fast. Your job is to make their decision easy. A clean proof pack includes:

Claim summary (product, units, what happened, dates, amount requested)

Invoice page with the relevant line highlighted

Screenshot or report showing the inventory problem

One-page cost breakdown

Amazon reimbursement cost breakdown template

What to do when Amazon asks for invoice reimbursement (But you don't have one)

Sometimes sellers source from:

Liquidation sales

Retail arbitrage

Mixed supplier channels

Older inventory with missing records

If Amazon asks for invoice reimbursement and you don't have a perfect invoice, try these options:

Request a duplicate invoice from your supplier (often the fastest solution)

Provide a purchase order + payment proof if the invoice is missing details

Get a commercial invoice from the freight forwarder if you used one for importing

Build the cost breakdown so even imperfect documents are easier to understand

Case-writing tips for cost-based reimbursement claim

Even with the right documents, how you write your message matters. Keep your case text short, structured, and specific. Use this simple format:

State the problem

Provide reference

Request action

Attach proof

How Refunzo helps you win cost-based reimbursements (Without the manual work)

Cost-based cases are absolutely winnable, but they’re also time-consuming. You first have to identify the discrepancy, then gather the right proof, match the correct product codes, and finally present clean, accurate calculations that Amazon can actually accept.

Each step demands precision, and missing even one detail can delay or derail the reimbursement entirely. Refunzo makes this process much easier for Amazon FBA sellers:

Run a lifetime-free reconciliation across 20+ potential problem areas

Get a clear, detailed report showing exactly what Amazon may owe you

Choose how you want to proceed with the claims yourself using accurate, ready-to-submit

data or let Refunzo handle everything for a simple success fee that is 15% of the recovered amount (capped at $5,000

Your goal is not to let cost-based reimbursements become a profit leak. Get back what's yours with proof that wins.

Final checklist before you submit a cost-based reimbursement claim

Ready to see what Amazon owes you?

If you suspect lost, damaged, or shorted inventory has been eating into your profits, run your free Amazon reconciliation audit with Refunzo and get a clear report. Then decide whether you want to file claims yourself or let us handle the work.

You've already done the hard part: building a business. Because every dollar you’re owed should end up back in your account.

Related post

Amazon Reimbursement

Cost-based reimbursements: The proof Amazon actually accepts

Cost-based reimbursements: The proof Amazon actually accepts

Cost-based reimbursements: The proof Amazon actually accepts

Cost-based reimbursements: The proof Amazon actually accepts

Jan 31, 2026

|

12 min

How Refunzo identifies that you lost inbound inventory automatically

How Refunzo identifies that you lost inbound inventory automatically

How Refunzo identifies that you lost inbound inventory automatically

How Refunzo identifies that you lost inbound inventory automatically

Jan 23, 2026

|

15 min

Amazon lost inbound claims

Amazon lost inbound claims Guide 2026 : How sellers can recover thousands in missing inventory

Amazon lost inbound claims Guide 2026 : How sellers can recover thousands in missing inventory

Amazon lost inbound claims Guide 2026 : How sellers can recover thousands in missing inventory

Amazon lost inbound claims Guide 2026 : How sellers can recover thousands in missing inventory

Jan 18, 2026

|

15 min

Stay updated by subscribing

to our newsletter.

Stay updated by subscribing

to our newsletter.

Stay informed and up-to-date with the latest news and updates

from our company by subscribing to our newsletter.

Stay informed and up-to-date

with the latest news and updates

from our company by subscribing to

our newsletter.